Stenos Signals #6 – Is growth no longer relevant?

Inflation runs markets currently as it seems as if growth has become irrelevant for policy makers, but will such a narrative pass a reality test? I doubt it. Growth will re-enter the limelight soon!

Wow, it is simply such an amazing feeling to be a father now. The little boy is doing great and my wife as well. Big ups to her by the way. What a fighter she is!

Having said that, let’s get down to business!

Jay Powell and the Fed intend to bring the policy rate above neutral in 2023 to combat inflation. Christine Lagarde and the ECB deliberately look beyond the European growth uncertainty and intend to fasten the process towards policy normalization despite a raging war in the backyard. It generally seems as if everyone and their mother has lost track of growth due to the current spike in prices. The International Energy Agency even published a 10-point plan to cut oil use in four months, which is basically designed to create a recession. The short resume is that we need to drive much less and slower and limit mobility markedly in general to contain energy prices. This is a recipe for an economic downturn since energy/mobility is the source of life for an economy.

My prediction is that growth will re-enter the limelight before long. Despite high prices, policy makers (including central bankers) cannot withstand negative economic growth for long before pivoting. Financial conditions have already tightened enough to bring about a mild manufacturing recession globally, which means that the DEMAND side of the commodity/energy equation will likely start softening very soon. This could prove to be a game-changer for the central bank outlook during Q3 and Q4. The Fed and the ECB are likely to remain on an ULTRA-hawkish path through Q2.

Chart 1. Financial conditions already suggest that Manufacturing PMIs will drop below 50 soon

On top of already tight financial conditions, the spill-overs from a weakening credit cycle remain mostly unseen. If usual correlations hold, then a contracting credit cycle will lead long bond yields LOWER and not higher during H2-2022. This will wrongfoot right about everyone, if true. The big litmus test of this credit impulse model is right in front of us. If inflation remains in the driving seat of all price action, then we won’t get a setback for long bond yields, but if growth re-enters the limelight, then 10-year bond yields may trade as much as 50-75 bps lower by year-end. I lean towards the latter, but I have admittedly been too early on that call so far.

Chart 2. The global credit impulse suggests that long bond yields will drop back in the second half of the year

It remains to be seen whether the demand side will get back in the driver’s seat of inflation developments, which obviously depends partly on Vladimir Putin (and other politicians) by now. Financial conditions (read, a leading indicator for demand) hint of inflation returning to levels BELOW target over the next 18 months.

Inflation ought to stabilize around 2% or just below 2% over the medium term given current financial conditions, if correlations from the past 20-25 years hold. There is hence no need for the Fed to tighten more than what is already priced in to forward markets for 2022/2023. In other words, we may have hit peak hawkishness by now.

Chart 3. Inflation will return to target given current market pricing of the Fed (financial conditions lead 6 quarter)

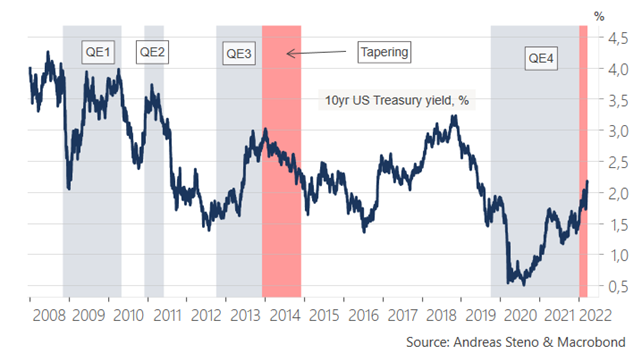

We still await the final details on the quantitative tightening (QT) process from the Federal Reserve (The Fed’s QT mechanics are explained by my friend Alfonso Peccatiello here), but I stick to the view that QT is likely to increase the flattening pressure on the yield curve even if the Fed policy makers hold the opposite opinion. Empirically, long bond yields have faded every time we approached the end of a QE program. Will this time be different? I doubt it.

Chart 4. Long bond yields tend to drop after the conclusion of QE

For now, I personally prefer to 1) remove chips from energy related stocks and commodities, 2) seek towards low beta/ defensive assets, 3) stay long the USD and 4) keep flattening the USD yield curve (e.g. in 2s10s or 5s30s)

Take care all!

100% agree with the conclusions, but I wonder how did you get that LHS chart for the GS FCI index? Or is it the BBG one?

Great work and congrats on the little one. One question, FED hikes will not bring the food and energy prices down effectively. As a result, the FED needs to slow or stop tightening earlier than a major reduction inflation. So the real yields will stay negative and at the top of that if the growth you mentioned starts rolling in, short dollar and long commodities needs to be in cards in near future, no? And long tech/growth?