Stenos Signals #5 – How do you trade stagflation?

Inflation is not going to peak in Q1 as the most recent price developments in energy- and food prices will lead inflation much higher in Q2. So, the question is now; How do you trade stagflation?

I can just as well admit to it up front. I haven’t had a lot of macro homeruns lately, but due to coincidences some of my main market calls (such as a strong USD and a much flatter yield curve) have performed anyway. I have been calling for a peak in inflation in March but that is surely not going to happen as the latest development in food- and energy markets will propel inflation a lot higher during Q2 and that is even before we consider the possibility of a rising shelter cost, which is a voluminous part of the inflation index (around 30% of the US Consumer Price Index).

If car, energy, food, and shelter prices rise markedly at the same time, then we have got a real- and nasty inflation picture to deal with for the average Joe, which is why the current price pressure ought to have disinflationary consequences down the road (demand will weaken), but that is not a tradeable storyline for the next few quarters.

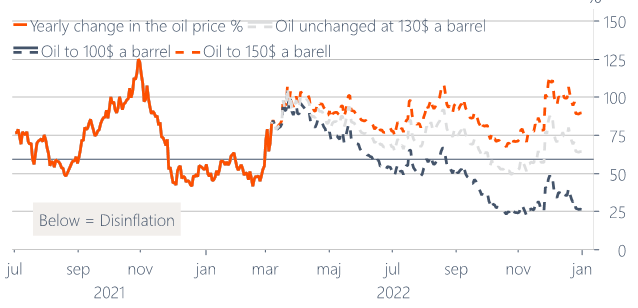

Chart 1. Energy inflation rates will remain sky-high throughout the year even if prices plateau now

Before the war in Ukraine, I started talking about substantial gravity effects pulling down inflation rates from Q2 and onwards as large parts of the inflation index would be measured against much higher base prices during the second half of the year. That case is no longer worthwhile pursuing as inflation rates will remain miles above central bank targets throughout 2022 unless we get a landslide in market prices between now and New Year’s, which is a highly unlikely scenario given what we observe from the supply side currently. This will leave central banks stuck between a rock and a hard place in Q2. Extreme inflation numbers and a bleak demand outlook. What would you do?

At least parts of the cooling of the economy will happen naturally due to a weak real wage growth and it is even debatable whether rate hikes will work to bring down the price of relatively price insensitive necessities already in scarce supply. We at least don’t have a lot of strong empirical evidence supporting that notion, but it might be that you can mix energy cheques to households and rate hikes in a weird cocktail. The Fed will probably hike cautiously during Q2, while the ECB is one big question mark ahead of Thursday’s meeting, but I simply struggle to imagine that Baltic- and Southern European members of the board would dare tightening monetary policy now given the risk of marked demand-side contagion from the war in Ukraine.

Chart 2. Why this is not the 70s all over again in one chart

A lot of commentators highlight the risk of a return to the 1970s with a continuously high inflation due to negative wage to inflation spiral, which would constitute a material regime shift compared to the 2010s. I do see some factors pointing in this direction and I also highlighted the risk of much higher inflation through 2021 because of those factors. First, governments have started running unfunded deficits again, which is much more inflationary in nature than “money printing” by central banks. Second, the suppliers of energy are once again in the driver’s seat of the price formation, which rather feels reminiscent of the oil embargo triggered recessions of the 1980s and thirdly, Covid was probably the final nail in the coffin for the outsourcing trend of the manufacturing apparatus as we simply learned the hard way how costly it can be to be fully reliant on China as the factory of the world through Covid.

BUT! There are two mega-differences to the 1970s. First, we are no longer an industrial economy with a booming labor force organized in super strong unions demanding huge real wage increases despite a strong cost pressure on companies. Second, the current gusts from 70s are faced with an exponential growth in technology, which means that companies need substantially less labor to produce the same amount of profit as fifty years ago. This is called productivity and companies probably won’t get better incentives than right now to invest in increasing productivity given the marked rise in input prices from both labor and materials. We will likely see the effects of those “forced” productivity gains in years to come. If this is enough for an already expensive tech sector to weather the storm through Q2 is a bit more debatable, but I remain calm about my structural exposure towards this sector and it is also noteworthy how for example Intel performed through the stagflationary 70s despite being a tech company.

Chart 3. Heatmap on quarterly inflation adjusted returns across asset classes during stagflation periods (1973 - today)

This brings me to the most important conclusion of this week’s blog. How do you trade markets that move towards a stagflationary environment now that inflation rates will continue up while growth is about to take a hit due to geopolitical turbulence? The best way to assess this question is via a historical study of empirical returns during times of actual stagflation dating back to the early 1970s.

Assets that tend to keep the value intact or even increase in real terms through a stagflation are typically negatively correlated to low or negative real rates, which is why gold and real estate (REITs) are some of the best places to hide during a stagflation. Equities overall struggle to perform in real terms and so do bonds, which might be even worse this time around due to the outset of bond yields into this potential stagflationary environment.

Even if I consider an actual return to a 1970s-like environment highly unlikely, it doesn’t exclude the possibility of markets trading toward such a scenario over the coming quarter(s). Position accordingly. Good luck.

Very timely post. Many thanks Andreas.

Excellent read! From my end, I see more of a decelerating growth and inflation for Q2/Q3 but time will tell. I'm a tactical, discretionary, trend following macro trader so I'm happy to ride whatever trend in whatever direction in whatever market but it's nice to have a decent grasp of macro economic fundamentals relating to the WHY of markets to complement the study and understanding of HOW markets move. Happy speculating!