Stenos Signals #12 - You will all hate me after this..

Germany is doing MUCH better than reported on the Nat Gas front, while everyone seems to agree upon a European zombie-apocalypse scenario making July/August the most hated rally ever.

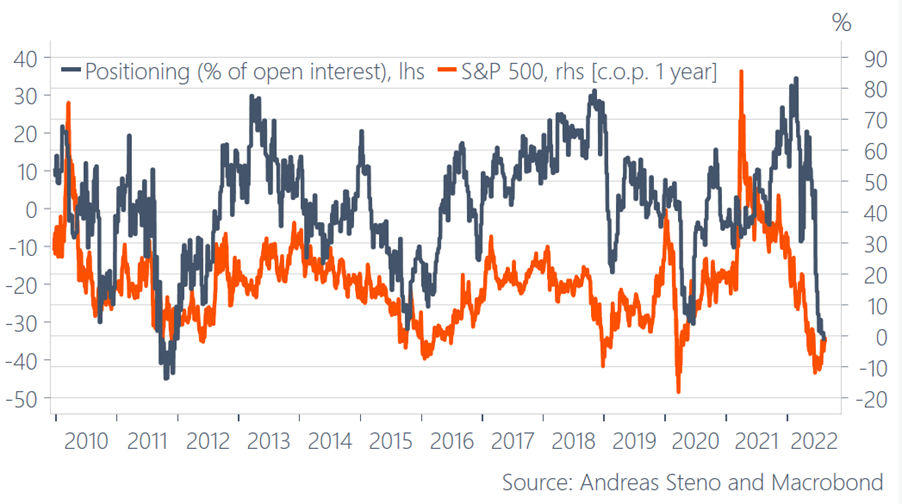

Welcome to the most hated rally ever… It’s a sea of green in equities over the past 6-8 weeks, Cathie Woods is back doing victory laps and meme stocks are making us scratch our heads again. I have interviewed a bunch of portfolio and hedge fund managers over the course of the current rally and the general takeaway is their very negative sentiment. I fully understand the bearish sentiment as it seems almost impossible to find any whatsoever glimpse of hope for the economic momentum, but as a rule of thumb, it is often profitable to turn right when everybody and their mother is going left.

Chart 1 - Positioning remains bearish from historical standards

The inflation outlook in the US seems to have peaked, while Europe continues to see red hot prints. Last week alone, the UK y/y CPI came in at 10.1% and in Germany the PPI y/y printed at 37.2%. Taking a deeper dive into the PPI numbers, energy prices rose 105.0% compared to July 2021, giving us some uncomfortable Weimar Republic vibes! Bundesbank Chief Joachim Nagel warned readers in Rheinische Post last week that a further escalation in energy prices would make Germany face a recession this winter.

I pointed out in my last newsletter how US inflation is leading Europe by 3 months and the recent prints confirm my conviction of long S&P 500 vs Dax trade, as European equity markets will have to cope 1) even higher inflation, 2) a recession and 3) A hawkish ECB in to Q4. The Bank of England is now priced to hike MORE than the Fed, which is a good example of the larger energy inflation woes in Europe. ECB next up?

Chart 2 - The Fed (orange) is no longer priced to be the most hawkish of the big three

On oil and the war between demand destruction and supply constraints

A possible deflationary shoe to drop is oil, which I have talked about previously. Oil prices have continued their downwards trend (with new lower lows) since they are priced based on the marginal buyer. Remember a 6% drop in oil demand in March/April 2020 lead to negative prices - with everything priced at the margin, even a small drop in demand may matter a lot from here. Therefore the marginal demand story is of extreme importance and if growth comes off even more, supply really needs to disappoint to keep prices up. A dark horse for oil prices is of course the natural gas situation in Europe. Gas prices are currently trading at an equivalent of almost 400 USD (in barrels of oil equivalents) and electricity prices are even worse, which might lead many to use heating oil instead, keeping up demand.

Chart 3. Electricity in Europe -> AAAAAAAAAAARGH!

Talking about Europe… Are we all too bearish on energy supply in Europe by now? The gas storage situation is improving rapidly in Europe. LNG terminals in Poland are already coming online before the winter while Germany could bring on LNG capacity at the latest in Q1 next year. Germany has already managed to increase the storage of gas materially hitting a new ALL-TIME-HIGH in daily injections this week. Yes, you heard me right - ALL TIME HIGH - despite <20% of usual russian flows. Germany has found new (and much more expensive) suppliers, so forget about the “Germans will freeze” doom-mongering.

The pricing of >1000 EUR per megawatt hour for electricity in Dec 2022 (and the equivalent Nat Gas future pricing) most likely needs a (managed) blackout scenario to be confirmed. Shielding of consumption by yuuuge compensation packages by governments will likely get Europe through the winter, but will likely also add further to the inflation down the road. I am keeping an eye on this with regards to my DAX short as you ultimately need to get Natural Gas right to get macro right currently and one thing is certain. An economy simply breaks with electricity prices at the current levels - a (sharp) recession is a done deal in Europe - the question is just to which extent it is already priced in.

Chart 4. New record high flows of natural gas into Germany - WHAAAAAT?

So to sum up my current positioning: Long SPX vs. DAX (with an open FX exposure currently), Long TLT (ouch recently) and the SALL (short commodities, but Nat Gas is a tricky one)..

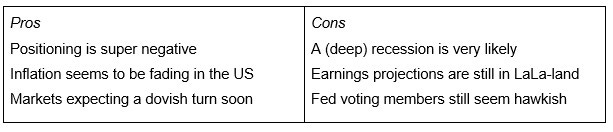

I am not yet loading up on everything with an arm and a leg despite this recent “most hated rally” and I consider the below table a fair depiction of the pros and cons of going long right now.

If you like my free content, you can donate directly here. Thanks very much for your contribution!

Finally, please help me share this free content with your friends on various Social Media channels.

Table 1: The pros and cons of equities this fall

Who doesn't love an Opposite Day post? Great work as always.

Andreas, i’m looking to take you up on your $DAX short but considering there hasn’t been any past historical data in terms of energy crisises, and that this is unprecedented, where exactly do i exit my position/set my TP?