Steno Signals #25 – Is there any energy left in the energy trade?

Energy has been THE performer of 2022, but is there any energy left in the trade as commodity markets are turning bearish? We look at price action and fundamentals underlying the consensus trade #1

Another Sunday, another Steno Signals ready for you!

I have been asked over and over in recent weeks to give an update on my view on energy, so I am going to spend most of this newsletter elaborating why I find the short-term potential to be very limited. Before I get to the reasons why Energy is likely to underperform short-term, let me just acknowledge that P/Es, implied yields and supply side considerations point to very solid energy performance in the coming decade, but not right now…

First, there is a substantial gap between energy stocks and energy markets. We rarely see such gaps materialize and this is one of the biggest gaps measured in standard-deviations over the past decade.

Since October physical markets have deteriorated due to slowing demand, while energy stocks have continued to rise. The best risk/reward expression of this gap is probably to be long physical oil and short energy stocks in a spread-trade, but my best guess is that the gap will be closed from the top (via falling energy stock prices)

Chart 1. One of the biggest gaps between energy stocks and energy markets in recent decades

We have relatively strong clarity on the supply side of commodities with OPEC confirming the policy stance today, while the G7 oil cap imposed on Russia is above most current traded Russian oil prices, meaning that the demand side is now the tricky part of the equation. I generally find that too many analysts focus on supply side economics in the commodity space, while the demand side is often much more volatile and trickier to grasp and hence a bigger driver of marginal price action.

The demand seems to be falling apart in front of our eyes right now. The freight rates from China to the US are falling of a cliff despite renewed restrictions in China. This is not just a symptom of easing supply chains; it is also a symptom of WEAK demand. Goods inflation is likely to run around 0% in May-2023 and this ought to be a most obvious hint for the demand of energy as well.

On top of that orders to inventories ratios in South Korea and Sweden (two cyclical canaries in the coal mine) are starting to look worse than 2008 making me more and more certain that a pretty deep cyclical contraction is knocking at our doors.

Chart 2. Goods deflation at 0% in May-2023

The overall demand picture leaves us with a bearish taste in our mouthsfor energy in to Q1-2023, but there are pockets of extreme supply scarcity that we still need to assess thoroughly. Impressively, Europe enters this heating season with one of the best storage situations in the past 10 years for Natural Gas.

This was one of the reasons why I went so firmly against the consensus back in August and September when European energy prices started spiraling out of control, but the picture is a bit more nuanced now and I think the probability of outcomes hint of renewed price pressures coming up in December/January.

Chart 3. One of the best storage situations over the past decade in Europe

Beneath the surface, we are starting to see some signs of weakness in the European gas supply chain. Dutch storages are already <90% and the temperature forecasts hint of a cold December as the base case now.

Let’s take the German example. The Germans have a storage capacity of 245 TWhs of natural gas, while the monthly consumption is likely to reach around 115-130 TWhs (given the weather forecast), which leaves around two months of total consumption at storage currently.

The monthly inflow is around 60-70 TWhs (depending on the amount of indirect imported LNG in coming months), meaning that the situation can become painful towards the very end of the winter still as the net “burn” of storage is at least 45 and at the max 70 TWhs per month. In the worst-case scenario of four winter months of 70 TWhs of net withdrawal per month, March could still prove to be tricky.

With cold weather expected in the coming weeks, I would be surprised to see TTF Dutch Natural Gas prices trading lower.

Chart 4. The storage picture in Europe is a bit more nuanced below the surface

I watch the daily withdrawals from German storage fiercely and we are yet to arrive at the 2-2.5 TWh per day territory that would challenge the supply outlook already for this winter… But outflows have nonetheless begun... Achtung, Achtung as they say!

Chart 5. Daily withdrawals have started in Germany

The energy positioning is still crowded and long, not least relative to other commodities. The only exception in energy space is natural gas positioning. Crude- and heating oil and gasoline are all long to stretched long and it seems like the energy crowd is not willing to fully capitulate despite recent months bearish price action in physical/paper markets. Being long Natural Gas (in Europe or in the US) versus a being short a broad basket of energy commodities makes a ton of sense, if you ask me.

Chart 6. Positioning in % of open interest across the commodity space. Energy LONG except for Natural Gas

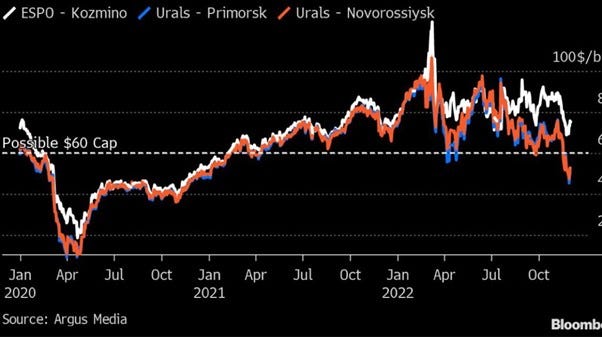

Even if the chief wind turbine enthusiast of the European Commission, Ursula von Der Leyen, cited the cap on Russian oil at 60$ a barrel as a huge victory, we find it hard to see the significance from a practical perspective. Primorsk/Novorossiysk oil is already trading below the threshold, why we find it hard to share the supply pessimism that surrounds the media coverage of the cap.

A price cap is per definition bound to fail. Water always finds the way and so does oil. Ships/cargos at risk of being fined for breaching the 60$ cap can just charge the clients in other creative ways… and ultimately, handing a price cartel a price cap to deal with, sounds like being destined to be challenged at that EXACT price cap, which is currently above trading Russian oil prices.

Chart 7. Russian oil prices already trade below the 60$ price cap

Before I leave you, let’s cross our fingers that the Frenchmen get the nukes online according to the latest plan. The forecasts for electricity production from EDF looks increasingly reminiscent of an inflation forecast from a central bank and the market is clearly yet to be convinced that enough nuclear capacity will be online by January to save France from an outright price catastrophe.

Chart 8. Next month we deliver!

The pricing of French electricity load in to January is still above all peaks seen in the spot price in August/September, while the forward pricing looks a little less dramatic in other European countries.

One needs to remember that France is one of the biggest net electricity exporters (in usual years), which leaves other countries such as Switzerland and Italy at risk of spill-over effects, if the nuclear capacity doesn’t come back online in time.

I have my doubts... It ain’t over till the fat lady sings, this European energy crisis.

Chart 9. Forward pricing of electricity in European countries

Summary:

1) I find compelling evidence of an interesting risk/reward in short US energy stocks in to Q1-2023 as the demand side is now in the driver’s seat of energy markets. (Short Energy vs. Long Industrials as an interesting spread expression)

2) Europe’s natural gas crisis looks decently contained for now and only in case of a harsh winter, we may be in for trouble come March-2023 – not before! The arrow points moderately up for TTF Dutch Natural Gas prices anyway…

3) All eyes on French nuclear production as electricity is now more interesting than gas in Europe. France is a HUGE net exporter usually and some of the surrounding countries may be in for a rude awakening, if France is not able to bring enough capacity back online in due time.

I have my doubts…

Great summary as usual. Thanks!

Great insightful read as usual. Thanks