3 charts that will wrongfoot all the bears

The consumer is rebounding fast due to several inflation-linked technicalities in January. Here are three charts showing why consumption will rebound markedly in H1-2023.

We have listened to the feedback and implemented a 2 week trial for subscriptions to Steno Research.

Get your FREE 2 week trial here → https://stenoresearch.com/subscribe/

3 charts that will wrongfoot all the bears

The boost to consumption in January has been a puzzle to many, but it actually makes sense if we look at the some of the underlying technical drivers of consumption. Bracket thresholds for federal personal income taxation levels have been increased markedly (due to inflation) in the US, meaning that the overall nominal taxation has been lowered markedly.

This has released around 250bn USDs worth of spending power annually from the get-go of 2023. Wages will eventually like play “catch up” to new taxation thresholds, but it is undoubtedly a short-term booster to consumption.

Chart 1. Fewer taxes, more consumption!

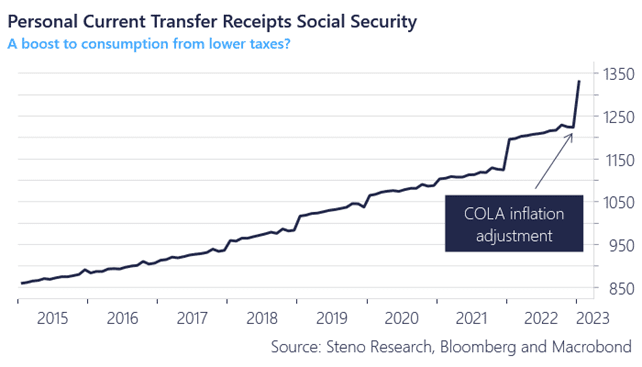

The yearly “COLA” inflation adjustment to social security benefits will add another 100bn to spending power after an 8.7% adjustment in January. This will be paid out to people with a high propensity to spend, why this arguably is another booster to short-term consumption in the US.

Tax reductions paired with inflation-adjustments to benefits have in total added around 350bn to the spending power on an annualized basis in January, which translated to a increase to personal disposable income of 2.5-3% in the US.

The consumer is back, and it will be felt in numbers this spring.

Chart 2. Transfer receipts got a nice little 8.7% boost in January

This renewed boost to spending is obviously bad news for hopes of bringing inflation down, but where I disagree with the doom-crowd is on the ramifications for global markets. If the spending power is UP, which it arguably is so far in 2023, it ought to be goods news for equities and risk appetite.

Increased tax thresholds and inflation adjustments to benefits are both to be characterized as federally fueled boosts to consumption, which are not going to increase the cost base of companies short-term and hence this is likely good news for earnings. Not bad.

Some of these trends were noticed by the great Bob Elliot of CIO Unlimited Funds on Twitter as well. If you do not follow Bob already, I can only strongly recommend you do it immediately.

Chart 3. Real wages up, equities up?

Want to find out MORE (and the rest of the charts)?

This was a short extract from our thought-provoking 5 things we watch series out every Wednesday. You can try us out for 2 weeks free of charge and read the rest of this weeks edition.

Get your FREE trial here → https://stenoresearch.com/subscribe/

Try out the worlds leading independent macro research shop for 2 weeks for FREE and remember our 100% money back guarantee if you dislike the product once you become a client.

We only want happy members!

Given consumption's weight in GDP, would this support a soft- or no-landing scenario in your view? If we avoid recession, then historical precedent would suggest that stocks bottomed last year.

At the same time, several things are lining up to support a rally in equities at least over the near-term.

In my view - based on no evidence other than daily incoming data provided by tradingeconomics.com - you Macro boys have lost the plot. A recession is further away because governments are handing around money to poor people like it's going out of fashion - not because they have a propensity to spend but because they damn well have to on things like energy (look at the ridiculous position in the UK which I assume is pretty similar elsewhere).

I see Charlie Bilello went pretty full-on bearish in his latest blog post and he has been equivocating for months.