USD Liquidity Watch: Treasury SELL-OFF due to increasing bank reserves?

The liquidity conditions will likely worsen substantially in US Treasury markets, and it is now a topic that is being addressed continuously by Fed members. Will the Fed opt to suspend the SLR again?

***This is a sneak-peak into our institutional coverage from www.stenoresearch.com. Contact sales@stenoresearch.com for a trial or find our team on Bloomberg***

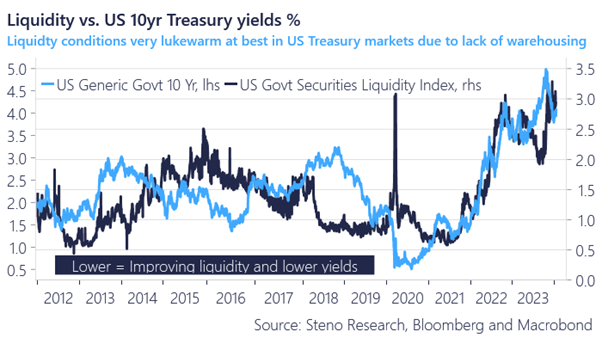

US Treasury liquidity conditions remain weak and the turmoil in Treasuries during the third quarter of 2023 probably played a major role in the Powell pivot in December in hindsight.

There are signs of increasing liquidity stress in US Treasury markets again, but how is that possible during a regime of increasing bank reserves (USD liquidity). It all has to do with the mechanics of leverage ratios in regulation. Liquidity conditions in US Treasuries are likely going to worsen substantially into the spring unless the Fed reacts.

Remember SLR? At least Michelle Bowman of the FOMC does as she addressed it directly in a speech earlier today.

Let’s briefly walk through the mechanics and how to trade the story!

Chart 1: Poor liquidity in US Treasuries rhymes with higher bond yields

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.