Stenos Signals #9: Demand is rolling over and markets are noticing

We have talked over and over about supply during the past 12 months, but it is now time to talk about demand. Go short the business cycle and buy USD.

It has been a while since I updated the newsletter, but the recent developments in markets have increased my conviction that the demand side is waning month by month currently. Forward looking indicators such as IFO expectations and Philly Fed new orders hint of a very weak second half of the year for manufacturing and even services may start to suffer because of a weakening purchasing power of consumers.

The weekly earnings data for US consumers is now running below trend for the first time since the Covid-pandemic hit and this ought to be the reason why inventories (adjusted for inflation) are starting to build across the globe. Not a good sign for the business cycle!

Chart 1. Earnings adjusted for inflation are now running (clearly) below trend again

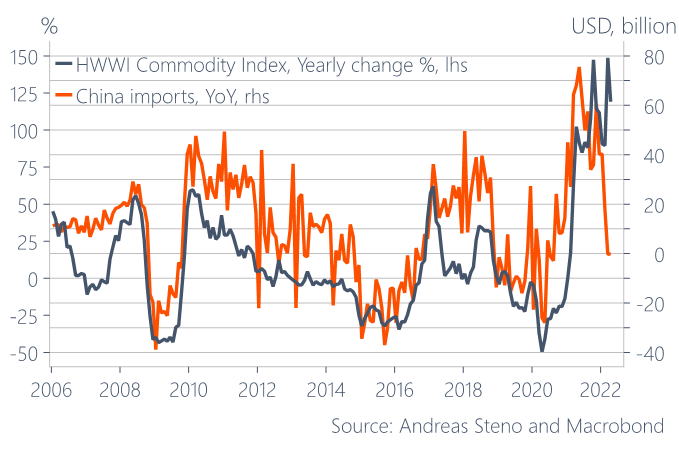

This means that it generally makes sense to be short the economic cycle in everything from commodity space to equity space. We have started seeing industrial metals rolling over, which rhymes with the lack of economic activity in China and the slowing demand in the West. This is likely going to lead inflation expectations LOWER as well, which in time may pave the way for bond performance, but I am still reluctant to re-enter that trade for a couple of reasons. The Fed for example still holds an incentive to tighten monetary policy as the lagged components of the inflation index such as the shelter costs continue rising.

The base-effects from a massive rise in the price of used cars in the early summer of 2021, prevented the yearly inflation rate from increasing further, but monthly numbers are hardly comforting as e.g. shelter costs and broad services inflation categories are rising the most in decades. This should leave the Fed on track to deliver a substantial QT- and rate hiking summer.

Secondly, big institutional investors are yet to fully re-position their risk exposure to their bearish stance as is for example revealed in the Global Fund Manager Survey from BofA. Investors are pessimistic on the economic performance ahead, but still hold a relatively risk friendly position in equities and credits. That disconnect will have to wane before I truly dare to re-add risk asset exposure to my list of recommendations.

Chart 2. China imports vs. Commodities – the most important macro chart in the world right now

This leaves me with a few suggestions on how to handle the current market environment from a macro perspective. It makes a ton of sense to add a long USD position vs. other FX peers to one’s investment basket in this kind of environment as the two major sources of USD liquidity are slowing at the same time.

First, global trade is slowing, which leads to fewer USDs being available for foreigners (as the US trade deficit will shrink) and second, the Fed is actively trying to bring down the number of USDs in circulation in the financial system. I decide to add the UUP (bullish USD ETF) to my basket targeting 30.50$ with a stop/loss at 27.15$ (compared to today’s level of 28.05$).

Chart 3. Global trade and the USD level are inversely correlated

Furthermore, I remain short one lot of MSCI Consumer Discretionary Index ETF and long 1 lot of iShares S&P 500 Consumer Staples Sector UCITS ETF as one way of expressing an equity view in this very tricky risk environment. Another way of playing it could be via a short position in Russel 2000 (MYY, SBB, and RWM ETFs are good proxies) versus a long position in a 0–3-month Treasury Bond ETF (long T-bills) with a low sensitivity to duration.

Lastly, remember to sign up to my new podcast “The Macro Trading Floor” – each week Alfonso Peccatiello and I invite a risk taker to unpack his or hers best macro trade idea and by the end of the show Alfonso and I will debate whether to buy the idea or not. A new episode of the show is released every Sunday on 9AM ET (15.00 CET). Stay tuned!

Great article with eye opening charts. Commodities correlating with all assets on sell off days have been happening and will probably continue. Especially when risk aversion gets combined with the falling China inputs. I like food and energy long term, but those assets will probably go on sale with everything else at some point.

Emerging market credit and fiscal crisis on the horizon alongside European economic weakness? I might broaden out from my emerging market equity short with some UUP.

Hi Andreas, I’m new to your sub stack, found this piece insightful and to the point. Clearly you have a granular and mechanical understanding of the markets. A question if I may: if as you suggest(which also appears to be a certainty) the FED starts to lift rates this summer, the impact on emerging market debt will be profound? Micro impact will force tax rises, when the economies are already battered post covid? Potentially more defaults moving from periphery towards the core?

As for USD shortages, I have heard there are already major usd shortages in Rwanda and Congo. Thanks