Stenos Signals #4 – Biden owns a printer, while Powell owns a flat iron

I remain of the view that it is inadvisable to make large portfolio changes during Geopolitical turbulence. Markets remain lukewarm despite the Russian aggression, so let’s look at the medium-term.

The blog in short

· QE is not money printing unless it is paired with direct transfers

· Demographics will keep pushing bond yields lower unless universal basic income is introduced

· China may be a good place to hide during these turbulent times

· The ECB will not hike in 2022

Before I get to the investment outlook, let me briefly touch upon the hottest economic topic on earth (Russia/Ukraine is geopolitics, not economics). Inflation is probably the only that can heat up the economic debate as much as currently. Wow, the camps are divided right now, and I see a lot of bad takes on what is going on with the current price formation (I said it was a heated economic argument). The worst article of the week was written by Professor Steve Hanke on the topic of so-called money printing. Hanke argues that Powell has been wrong on inflation as he failed to understand that QE leads to inflation. Hereafter, Hanke presents an inflation model built on the so-called equation of exchange theory (M*V=P*Q), but the model only predicts actual inflation after a time-lag and it also fails to predict anything at all during 2020, when we had the first massive increase in the broad money supply in a while. I by the way don’t think I need a model to predict what has already happened, but I may be wrong.

Let me try and explain how I look at the question of so-called money printing and its link to inflation.

Chart 1. The broad money supply didn’t accelerate until the US Treasury entered the (QE)-frame

In a regular QE scheme, a central bank buys a bond from a financial counterpart and offers freshly created reserve assets in return (this is not to confuse with money). The new reserve assets can only be used in transactions between entities with an account at the central bank (effectively other commercial banks), which means they cannot leave the financial system. It is simply impossible for a bank to lend out the reserve asset to Average Joe or Walmart, why QE has no direct impact on the price level (of goods and services) in the real economy. There were hence no material pick-ups in the broader money supply (M2) to be seen during the QE 1.0 wave (2010-2020), but something suddenly happened during the pandemic.

When you pair QE with a set of very effective redistribution mechanisms, we get to a whole different conclusion. First, the US Treasury (or rather politicians) opted to transfer a lot of USDs directly to households and corporates on an unfunded basis. If a government decides to hand out money with no intention of collecting them again via taxes (a structurally unfunded fiscal deficit), it will lead to a broad increase in the money supply. Effectively the US Treasury issued bonds, the Fed bought them (with new reserve assets), and politicians handed the USDs out to the public throughout 2020 and 2021. This is inflationary, in sharp contrast to what we experienced during the QE 1.0 era between 2010-2020. Effectively, it is therefore Biden who controls the actual money printer, while Powell only owns a flat iron unless Biden plays ball.

The big question is now whether the direct transfers will become perma-instruments in the fiscal policy toolbox (a de facto universal basic income) or whether the pandemic was of such an odd character that it required an odd- and temporary universal basic income model. I am still undecided on that question, and until I get a firmer signal that I need to pencil in a permanent universal basic income, I still think that inflation and bond markets will be governed by other structural trends over the medium term.

Just look at the growth rate of the working age population (10 years forward) versus the term premium of US Treasury bonds. The current bond bear market is not standing on structural pillars. I still feel very certain about that.

Chart 2. Bond yields remain governed by demographics over the medium-term. Low(er) for longer

This is ultimately good news for the tech stocks that are currently out of favor, but it admittedly remains tricky to time the entry given the current turbulence in Ukraine. I stick to my allocation towards the segment, but I currently don’t feel truly tempted to add to it. Rather, I continue to look at China as an interesting market to scale up – both in fixed income and in equity space. One of the better performing equity markets over the past week is namely China (SSEC), which goes to show that it is preferable to allocate towards markets with a solid backing by the central bank, when the wind starts blowing a bit.

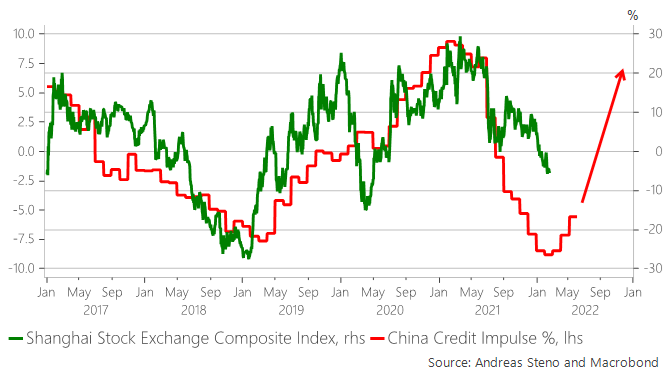

The Chinese central bank (PBoC) and the authorities have started a process toward refueling credit growth in the broader economy, after they spent most of last year ensuring that they had an iron grip on Evergrande and its peers. When the PBoC refuels the credit cycle in China, the Chinese equity market is one of the first markets to price it in (after 3-4 months of time-lag) meaning that we probably have at least a decent investment climate in Chinese stocks ahead during Q2 almost no matter what happens in Ukraine.

Chart 3. When the Chinese authorities put the pedal to metal, it is a good idea to follow suit

Finally, let me spend a couple of paragraphs on the widow-maker number one in 2021 – namely the front-end of the EUR curve. Leveraged carry/roll strategies have been popular through 2019 and 2020 as the ECB had almost killed the yield curve, why levered funds partied in the front-end of the EUR curve. Andrew Bailey from Bank of England annihilated all those positions during Q4 of 2021 and since then even the ECB has joined the other big central banks in fostering front-end volatility.

In February, the ECB turned outright scared of inflation and Lagarde communicated that the inflationary nervousness was unanimous within the board. The inflation in the Euro area is to a large extent driven by pandemic supply effects and the self-inflicted energy crisis, while the inflation picture is clearly broader in the US.

First, it makes little sense to hike due to supply side issues unless a fierce price/wage spiral is ongoing, and we are yet to see signs of that in the Euro area. Second, the supply side outlook is starting to brighten slowly but surely as we see green shoots in for example shipping data. Even if the port of Los Angeles has clearly moved the goalpost in the data on the average number of days a ship is stuck at anchor or berth, I still struggle to construe it as anything but early good news on the supply side. The issues are clearly not gone, but they have probably already peaked. This is ultimately disinflationary – not least in the Euro zone. Do you dare trying the widow-maker position again?

Chart 4. LA port traffic vs. ECB pricing. Time to try the widow-maker position again?

Unfortunately, I think it has never been more important to take the geopolitical situation into account when looking at one's portfolio composition, but I hope I'm wrong.

If you keep it simple, and "just" look at oil, then Russia produces approx. 10 mbpd, of which they export approx. 4 mbpd - mainly to Western Europe. Even if they are allowed and want to, there is an overwhelming probability that a large part - maybe all 4 mbpd will disappear from the world market, and it is not possible to change the recipient country to China as the exports to it run at full capacity through pipelines.

This is because all Western oil companies have thrown away their activities in the country, and thus the expertise with which they contributed; as soon as oil service companies like Baker Hughes, Schlumnberger and Halliburton stop operating in Russia, the entire production apparatus decays rapidly; oil tankers cannot insure their ships if they go to Russian ports, and therefore do not want their oil on board;

Russia does not have a very large capacity in oil tanks on land, which means that they will very soon be in a situation where they can not get rid of their oil, and must therefore close production, with no prospect of soon production again.

This will cause the oil price to rise significantly, as there is no spare capacity in the vicinity of the decommissioned production.

Some oil producing countries will limit / stop their oil exports, which will cause the oil price to rise even more, and soon it will approach $ 200 per barrel.

I dare not even think about what happens to the oil price if the oil stands still in the pipeline in the Siberian winter - the oil will freeze, the pipes will burst, and then it is much more than 4 mbpd the world will lack ...

I think the above scenario has a high probability and it will have huge consequences for investing in the short, medium and long term.

The arguments on long-end of the curve being driven by demographics are a bit overblown. Look at Russia, terrible demographics, yet long rates are elevated. Look at Chine.