Stenos Signals #3 – The bluff of a decade?

A lot of investors are rightfully scared that Russia is about to invade Ukraine. It almost never pays to bet on geopolitical turbulence and the current situation may prove to be a decent opportunity.

I generally prefer to stay out of geopolitical bets as they are notoriously tough to predict, which is no different this time around with the renewed tensions around Russia and Ukraine. The worst thing about geopolitical risks is that it is so hard to predict the timing due to the volatile nature of actions from politicians and officials, making it difficult to enter and exit these trades with a decent conviction.

One none the less often needs to take a stance on geopolitical hard matters such as the potential conflict in Ukraine. My base case is still that this is the bluff of a decade from the Russians as they have tried to force the Germans into ratifying the Nordstream-2 pipeline since the fall as the external pressure on Germany to scrap the deal was rising from both France and the US, who are both strongly opposed to the idea of opening the extra gas pipeline via the North Sea.

The Russians have hence tried to manufacture a scenario in which the Germans simply have no choice but to ratify Nordstream 2 to bring down electricity prices for the average consumer, why Gazprom has deliberately kept gas supply/storages low in Germany through the fall, even before anyone in financial markets detected it. The huge Rehden storage facility in Germany has been running almost empty since August or September, which is at least part of the reason why natural gas prices are running at bizarre levels with an elevated electricity bill for consumers as a consequence.

The Redhen storage is operated by Gazprom, why it seems likely that the Russians have forced a situation where Germany will have to ratify the new pipeline to avoid lasting price increases, which is exactly the geopolitical crossroads that the Germans are now standing at. Germany can ratify Nordstream 2 and automatically decrease the strategic value of Ukraine to Nato and the EU or else continue the standoff with Putin with high prices on energy consequently. This is not an easy question for the new chancellor Olaf Scholz, but it seems as if the Russians hold the upper hand, why a ratification of Nordstream 2 is ultimately likely during the spring, which will probably make gas prices fall of a cliff once it is announced. Expect inflation to drop back sharply afterwards, even if the medium-term consequences are a bit blurry geopolitically, if Germany allows Russia to win this one.

What is the bottom line of this geopolitical rambling? First, natural gas prices are likely to fall of a cliff once Germany eventually ratifies Nordstream. Second, energy and electricity inflation, which are by far the most toxic components of inflation in Europe, are likely to drop back afterwards. Third, it is rarely a good idea to hit the panic sell button due to geopolitical headlines. Stay invested instead.

Missing the forest for the trees

The crisis at the Ukrainian border is another prime example of an event that might derail investors attention from what really matters, and it is often a bad idea to change the investment strategy just because of a truckload of geopolitical headlines. Currently everyone has accepted that labor markets are running much tighter than prior to Covid, possibly due to low mobility but also due to a smaller work force returning to the labor market after the pandemic.

Even the Fed has suddenly bought into this narrative and accepted that participation ratios are structurally lower now, which is in sharp contrast to how for example Lael Brainard communicated during the pandemic. The Fed of 2020/2021 kept communicating that participation ratios, also specifically for minorities, had to bounce at least to pre-Covid levels to hint of a full employment in the economy. Now they claim that labor markets are tight at clearly lower participation ratios than prior to Covid.

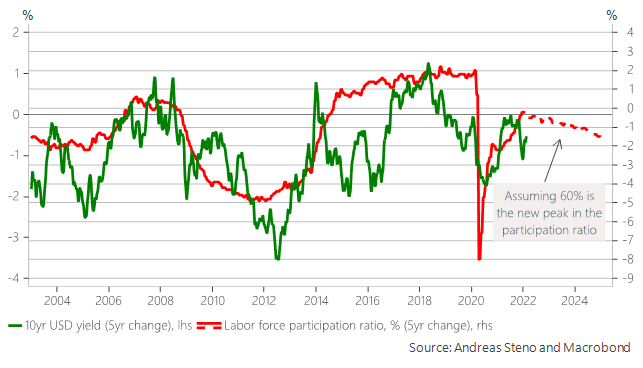

It might very well be that the labor force has lastingly taken a hit during the pandemic as boomers ain’t returning to work due to stunning wealth effects over the past decade. Short-term, this pivot from the Fed is obviously hawkish and they are going to hike a series of times this year due to it, but you ultimately don’t want to miss the forest for the trees. When the labor force shrinks, it may provide an early hint that structural growth has weakened, why there is a strong long-term correlation between participation ratio trends and trends in long bond yields. If the participation peaks at a weaker level than prior to Covid, you should also expect long bond yields to peak at a lower level than prior to Covid, which ultimately makes the case for going long duration again already now, as we have now surpassed yield levels seen immediately before the Pandemic on e.g., 10yr bonds.

Risk/reward seems decent for going long >10year bonds to me, which also means that growth stocks may be ripe for a broad-based rebound in Q2, while also parts of the EM space will perform. In EM, I still look to be long China as they are once again stimulating the economy like crazy, which is likely going to underpin the otherwise suffering tech- and real estate sectors in China. Remember that inflation is battling against gravity for the remainder of the year, meaning that we will have to see bizarre new price increases, if the inflation is to beat base effects. It most likely won’t, rather there is a risk of an inflationary nosedive in the second half of the year.

Best wishes from Andreas and let’s hope for peace in Ukraine. For the sake of everyone.

When to buy and when to sell is always something with one's time horizon. If you are long-term investor, then I don't think it is a good strategy to buy growth stocks now.

The US has a debt of 122% relative to GDP, I could well imagine that they are happy with high inflation for some time, just until the debt relative to GDP is at a manageable level - even if it happens at the expense of some growth.

I think the focus has shifted from the few rich to the many poor ...

Hi, the red line in the last chart assumes that the peak in the participation rate is 60%. We are at 62.2 now, so I don't quite understand that statement. Can you pls help elaborate?

https://fred.stlouisfed.org/series/CIVPART

Best,

Jacob