Stenos Signals #1 - Don’t take a bet against gravity!

Everyone currently panic about high inflation and a weak labour supply, which has catapulted front-end pricing central banks higher. I would prefer to not take a bet against gravity!

Hello and welcome to my new blog. It has been a while since I have written about my strategic views, but once again I find that consensus is overly hysterical about current developments. I tried to yell as loud as I could through 2021 that inflation would surprise massively to the upside, and that major central banks were oddly dovishly mispriced as a consequence.

I now find that consensus has gotten ahead of itself in its current tightening mode since gravity will soon kick in. The Fed is priced to hike five times this year (>100 bps), while the ECB pricing also looks for >40 bps of hikes over the coming 12 months. When even the “Laggard(e)s” in Frankfurt are priced to hike materially, it may be worth thinking twice about the current narrative.

I will aim at sticking to a short but sweet market narrative in this blog, so expect loads of charts and fewer words than usual.

Key points of the blog:

1) Inflation will soon be hit by a massive “gravity pull”, which usually leads to a less aggressive central bank pricing

2) Liquidity momentum is about to turn dismal, which may lead spreads wider and risk premias higher (temporarily at least)

3) Medium-term dynamics of the Covid-fuelled labour scarcity are probably dovish rather than hawkish for rates

4) Accordingly, tech/innovation may rebound, long bond yields will likely not rise over the next couple of quarters and cyclical assets such as industrial commodities and energy linked equities may suffer - this is a strategic view for Q2-Q3.

Let me be clear upfront. I think there is a scope for hikes within many G10 central banks – I just find it overly baked into market pricing by now, and the main reason is that gravity pulls on right about every front during 2022. Inflation will face a fierce battle against massive base effects, which will ultimately lead inflation much lower already during Q2-Q3. The fiscal impulse from government deficits will wane drastically compared to 2021, which is almost certain to tame growth quicker than the consensus currently expects. Finally, credit creation started waning through H2-2021, which is usually an issue for activity levels with a 6–12-month time lag. Gravity pulls!

Let me give you a few examples:

If oil the oil price trades in a straight line towards 125$ a barrel, energy prices willstill have a disinflationary impact on the CPI index in year over year terms during Q3-Q4.

If oil trades at a 100$, the inflationary impact is HALFED by Q3-Q4 and this is despite a further increase in the price compared to the current spot level. Gravity already starts to pull from April/May as can be seen from the below chart.

Chart 1. The oil price will likely disinflate the CPI index in year over years terms

The price of natural gas in Rotterdam can increase to 500€ (from current 92€) and still ultimately lead to a smaller inflationary impact (in YoY terms) compared to today. If the price of natural gas remains unchanged from current spot levels (light green line), then we would see an outright deflationary impact on Q4 inflation prints. The gravity effect is already material during Q2.

Chart 2. Natural gas price scenarios and the inflationary impact

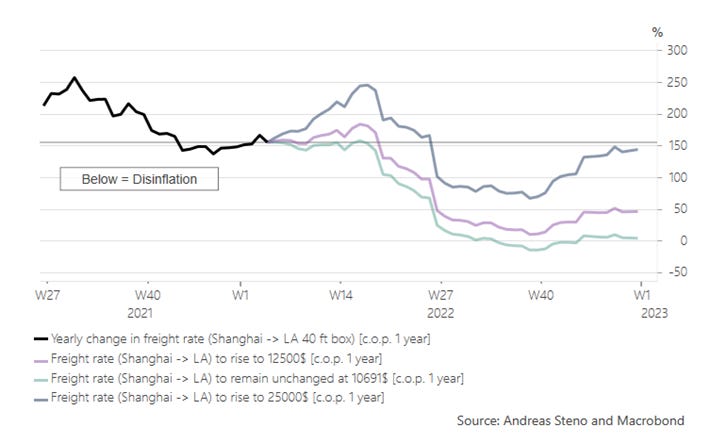

Freight rates (that are currently falling slightly again) will also be less than half as inflationary, even if a 40 ft box transported from Shanghai to LA increases by 2500$ in transportation costs from now and until New Years. The gravity effect is material already in early Q3.

Chart 3. Freight rates scenarios and the inflationary impact

All in all, this suggests that if you are betting on further increases in inflation, you are essentially taking a bet AGAINST gravity. If you dislike this blog-post, I urge you to have a debate with Newton on whether betting against gravity is a good idea :)..

Growth momentum is on the other hand weakening as 1) central banks withdraw the punchbowl in a coordinated way, 2) lagged effects of a weak credit creation during H2-2021 kick in and 3) fiscal impulses are waning fast (due to tightening deficits).

Credit spreads (or risk premias) tend to follow leading growth indicators with a time-lag of 3-4 months, which means that Q2 is likely to lead to wider premias in the run-up to the much anticipated QT-process from the Federal Reserve.

Chart 4. The momentum in leading indicators suggests wider spreads before summer

When credit is paid back (e.g. early via repayments of liquidity facilities at banks), it means that USDs, EURs and GBPs are literally removed from the real economy. The QT process from the Federal Reserve will only remove reserves from the interbank system, which is less of a pain compared to a material credit contraction.

A QT process may carry negative repercussions for risk assets anyway as an extreme liquidity abundancy in the banking system indirectly spurs risk taking via for example collateral scarcity and super compressed repo rates and term premias. Interestingly, a liquidity withdrawal usually leads long (quality) bond yields lower as 1) central banks leave a portion of the inner part of the risk curve up for grabs, 2) flight to quality effects of a liquidity removal kick in and 3) disinflationary effects from a reduction in risk taking and the according increase in the average cost of capital lead inflation expectations lower.

Chart 5. A liquidity withdrawal usually leads to wider spreads, but a lower base via lower swap rates

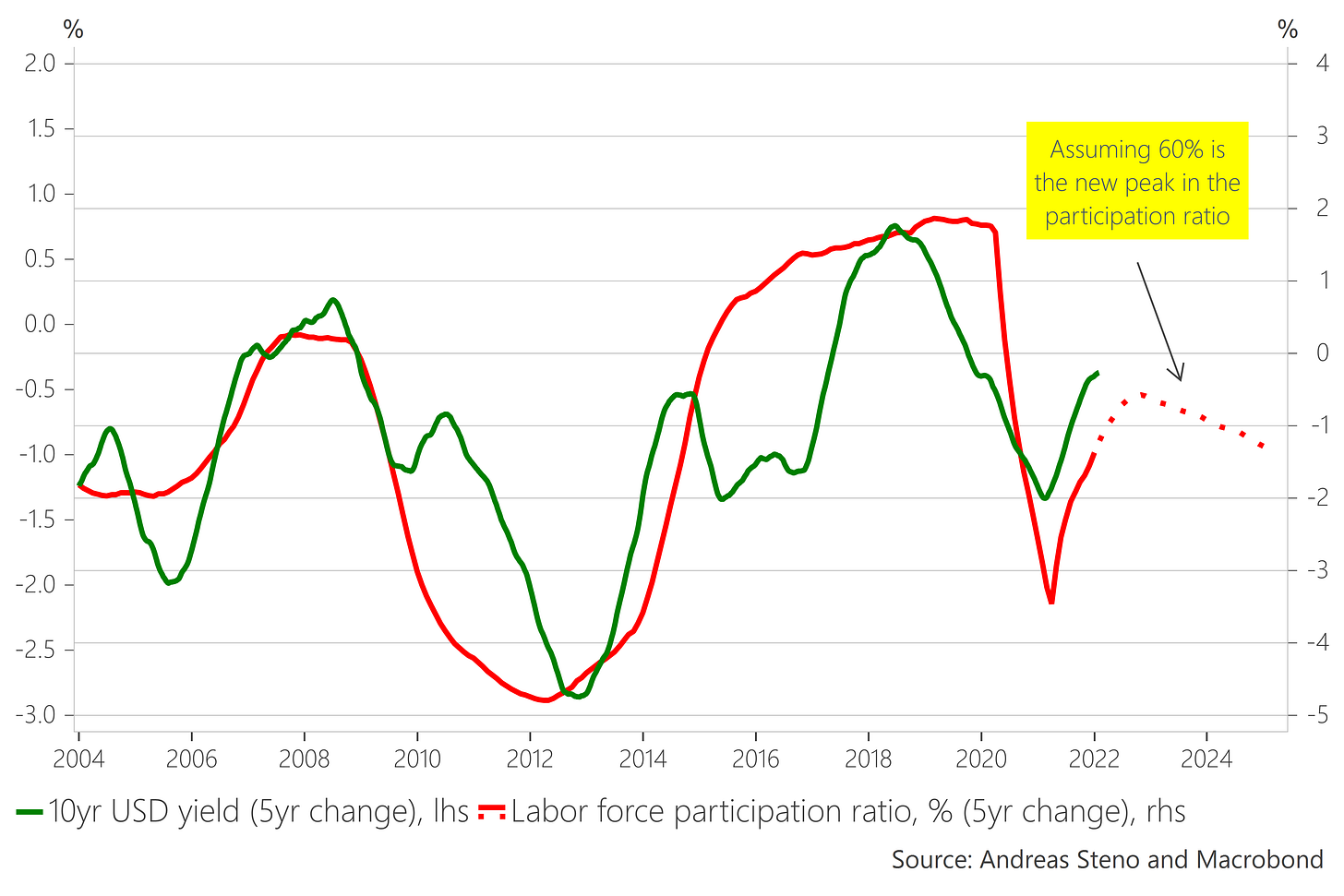

Finally, let me just quickly touch upon the current discussion on the labour market effects of the pandemic. The labour supply has quiet visibly dropped because of 1) Covid-fears and 2) positive wealth effects (there may be other possible explanations as well). If the shrinking labour market participation is of a more permanent character, it may ultimately be DOVISH news for rates in sharp contrast to the current consensus.

A weak labour market supply will force digitization to re-accelerate over the medium-term, which is usually bond bullish (lower bond yields) not the opposite. The long-term empirical correlation between labour market supply and long bond yield is basically indisputable.

So yes, the Jay-Man may hike several times this year (I don’t find that more than 4 hikes is feasible), but the current trends are ultimately dovish… Low(er) for longer is the endgame.

Chart 6. USD yield changes vs changes in the labour force participation

Please feel free to leave questions, comments and feedback here. Hope you all enjoyed it!

Hi Steno,

Thank you very much for writing this post. There are two ideas I don't really get:

- "The price of natural gas in Rotterdam can increase to 500€ (from current 92€) and still ultimately lead to a smaller inflationary impact (in YoY terms) compared to today. " I cannot see how a +400% increase in energy prices can have small inflationary impact. Actually, one of the reasons why I think inflation will be temporary in the US but will stay in the EU for longer is that in Europe energy prices have gone through the roof, and this has come here to stay. Trends in energy prices ripple in the economy across the board. The same logic I think applies to the analysis and the relations on Freight rates and inflation, though the relation is not that stronger.

- "A weak labour market supply will force digitization to re-accelerate over the medium-term". Assuming this happens this way, the trend would be self-reinforcing: less labour supply will lead to even less labour supply due to substitution of humans brought by more digitization. People leaving the workforce also want to have food in their plate. That leads to more government-sponsored programs, subsidies, aids, etc. and all of that comes with more inflationary pressure.

Could you please explain more on the above? It would be very appreciated.

Thank you very much indeed.

Best regards

Javier