Steno Signals #60: Worse than Lehman in China!? The 3 most important questions right now!

Either the commodity market is 100% wrong or else China is amidst a rebound. Is the Chinese credit cycle worse than Lehman? Here are the 3 main questions to ask as investor right now!

Happy Sunday and Welcome to our weekly flagship editorial.

The markets over the past week or two have made little sense as commodities (especially energy) have continued to outperform risk assets despite China apparently suffering from long-covid symptoms economically. Chinese money and credit trends look worse than US trends post Lehman, which means that either China rebounds or else it is the end of the Chinese economy as we know it!

We have timed our rotation from high-beta tech/AI to Energy/Commodity proxies amazingly well, but we need to remain vigilant at this juncture. What if the Commodity market is wrong?

Let’s have a look at the three most important questions for macro investors right now.

Question 1: Is China doing worse or better than feared?

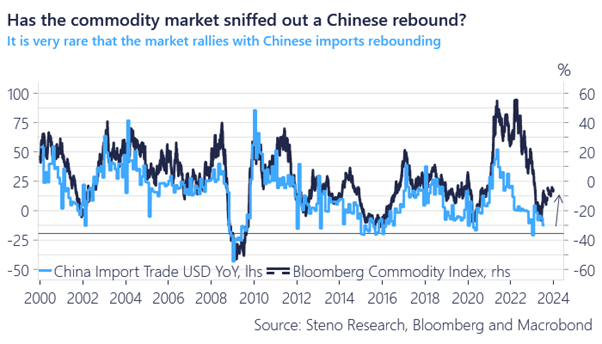

Our take: Either commoditíes are 100% wrong or else China is rebounding right now.

Everything out of China just smells like a balance sheet recession right now.First, Country Garden (the former largest developer) will suspend trading with 10 local debt instruments on Monday, ii) import/export numbers are in free fall and iii) high frequent indicators hint of a weak July/August as well.

But it doesn’t rhyme at all with an increasing momentum in energy space and also in broader commodities over the same period. With China being the biggest consumer of broad commodities on the global market, it is VERY rare that commodities rebound without having the Chinese economy on board the trend.

Has the commodity market sniffed out something or is the latest move the false flag of a decade due to false hopium of a CCP sponsored stimulus package?

Chat 1: Something’s gotta give, either commodities or China

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.