Steno Signals #35 – Everyone is going to be surprised by rising global liquidity!

We have spent many hours discussing the liquidity outlook in the US, but developments elsewhere are also interesting. JPY+CNY liquidity is on the RISE, which has turned the tide on GLOBAL liquidity

Happy Sunday folks and welcome to an FREE extract from our flagship If you want to join the Steno Research family, you can subscribe here → https://stenoresearch.com/subscribe/

Let’s have a look at GLOBAL liquidity trends since something really interesting may be happening beneath the surface of the financial market.

Most macro pundits in the US (or in Europe for that matter) spend COUNTLESS hours in USD liquidity forecasting and Fed watching, but as balance sheets of other big central banks have grown substantially more impactful in recent years, we obviously ought to track liquidity on a global scale and not on a local scale.

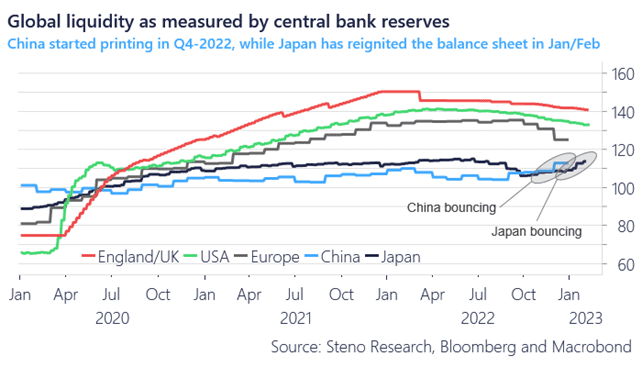

Interestingly, we see an increasing discrepancy between the big three Western central banks and trends seen elsewhere. The Bank of England, the ECB, and the Fed (outside when the US Treasury wreaks havoc with it) are all still trying to bring down the balance sheet size, while the Bank of Japan and the People’s bank of China now actively move in the opposite direction.

Chart 1. Increasingly diverging liquidity trends in Asia relative to the West

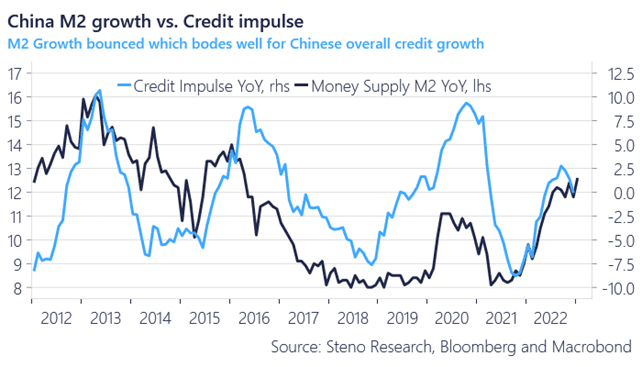

In China, the rebound in liquidity / reserves is obviously linked to the reopening and we received the latest set of monthly M2 growth numbers last week with compelling evidence of a renewed spike in money/credit creation in China through January. If the Politburo is now actively underpinning credit creation (to save the momentum in Chinese RE), we ought to see it as a positive global liquidity impulse relative to last year, where even China had no or even negative credit creation.

Chart 2. Credit is now GROWING in China again

Bank of Japan officials have also clearly started increasing the balance sheet to support the yield curve control through January. The balance sheet increase of Bank of Japan OUTPACED the Fed liquidity aircraft carrier from March-2022 in “annualized” USD-terms in the run-up to the last BoJ meeting and remember that the Japanese economy is around 1/4 the size of the US ditto. CRAZY numbers.

Net/net the combination of PBoC liquidity injections, massive BoJ YCC efforts and the US Treasury drawing down on the Treasury General Account have been enough to already TURN THE TIDE on global liquidity. If global liquidity truly bottomed in late 2022, it ought to be massive news for asset allocation.

Chart 3. Global liquidity bottomed in November 2022, which is a main driver of the current equity “optimism”

This was all from the FREE extract of Steno Signals - the only weekly to update you on GLOBAL liquidity trends. Find out how to become a member for only 29 USDs a month below.

Step by step: How to become a part of the Steno Research team?

1. Choose one of our offered subscription-packages

Basic: Gives access to Steno Signals, The Great Game and Five Things We Watch

Premium: Gives access to all of the above, all Watch-series (detailed knowledge on asset allocation) AND our dynamic data-dashboard with price models and asset allocation strategies across assets when it is launched shortly.

2. Subscribe here → https://stenoresearch.com/subscribe/

If you have questions or want to buy a package of licenses and/or live access to the analyst team for your company or institution, please contact info@stenoresearch.com