Steno Signals #33 - Introducing our prime Macro Asset Allocation Framework

Introducing our prime Macro Asset Allocation Framework – “Steno Signals Macro Regime Indicator”

***This is an extract of the weekly editorial Steno Signals. If you want to read the entire analysis, you will have to become a client of Steno Research. We give you 20% off until Jan 31. See more at the bottom***

Introducing our prime macro asset allocation framework – “Steno Signals Macro Regime Indicator”

We will launch our thoroughly back tested (with GREAT results) Macro Regime Indicator allocation tool during February for premium clients of Steno Research in our Data Dashboard section and on an ad-hoc basis for basic members.

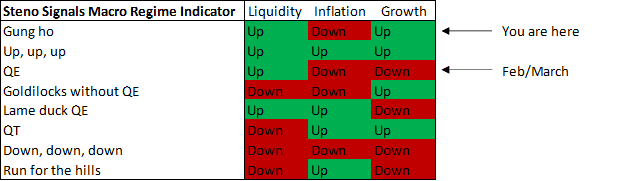

We measure the macro regime (in each currency/country) based on 1) liquidity conditions, 2) inflation and 3) growth.

In January, total USD liquidity has gone up, US inflation has come down and US growth has rebounded (at least in the S&P PMIs), which is what we label the “Gung-Ho” macro regime that allows for ALL types of risk-taking including monkey jpgs and or dog-coins.

We are likely to move a bit lower on the “macro regime ladder” in February and March due to weakness in ISM PMIs re-surfacing the growth scare, but as long as liquidity increases, it may still lead to a decent environment for risk taking.

We will take you through the entire methodology and our best assessment of the forward-looking outlook on each of three model variables in our “Asset Allocation Watch Series” later this week (only available for premium clients).

Chart 6: Introducing the Steno Signals Macro Regime Indicator

Before we move to the week ahead, we want to reveal some of the other tools that will be available in our data dashboard session soon. For each of the important asset allocation variables, we will host continously updated “Beta-trackers”, which will provide a hint on how to asset allocate in each asset class based on assumptions for key macro variables.

If you expect the CPI to drop markedly, you e.g. want to sell Energy and Financials and buy Consumer Discretionary and Technology stocks.

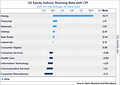

Chart 7. Stock sector Beta to US CPI (Beta = An increase of 1%-point in US CPI = x % move in the sector)

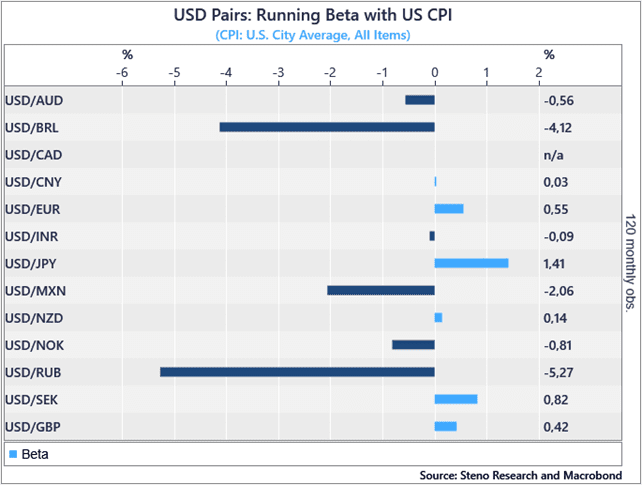

In foreign exchange space, it is less clear whether a declining US CPI is good or bad news for the USD. It depends a bit on which currency you measure it against, but we are happy to see two of our short-term favorite picks, JPY and SEK, as some of the top-picks should US CPI inflation wane further.

Chart 8. FX beta to US CPI (Beta = A 1%-point increase in US CPI = x % move in USD/XXX currency pair)

If you want running access to our allocation models you will have to become a client of Steno Research at www.stenoresearch.com/subscribe/ - remember that we provide 20% off with “substack20” - but only until January 31.

The offer ends in just two days, so be sure to make good use of it.

Step by step: How to become a part of the Steno Research team?

Choose one of our offered subscription-packages

Use our coupon substack20 to get 20% off your first purchase!

Become part of the best macro team on the globe

Subscribe here → https://stenoresearch.com/subscribe/

If you want to buy a package of licenses and/or live access to the analyst team for your company or institution, please contact info@stenoresearch.com