STENO SIGNALS #32 – INTRODUCING “THE WALLER RULE” causing S&P to bottom in 3200-3300 in H2-2023?

Waller from the FOMC has hinted when the QT process ends. The current debt ceiling stand-off is likely to prolong QT in this Waller framework, while the terminal value of USD reserves remains the same

Dear all,

We have received tremendous feedback on our Sunday editorial introducing “The Waller Rule” and why that rule is bad news for risk assets in H2-2023.

We will provide you with a mini-extract for FREE here, but if you want to learn about the rule in it’s entirety, you can use “substack20” to get 20% off on www.stenoresearch.com/subscribe/ ..

The offer ENDS on January 31, so make good use of it already now.

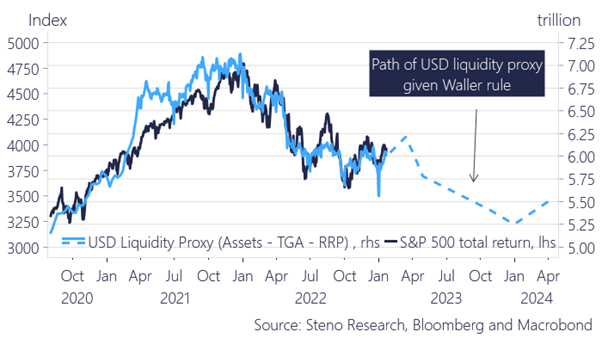

We now know the terminal value of USD reserves in the financial system. Isn’t that amazing? It probably means that quantitative tightening is fully priced in as we all have full information on the balance sheet policy by now. Not so fast.. “The Waller Rule” points to S&P 500 at 3250 in H2-2023.

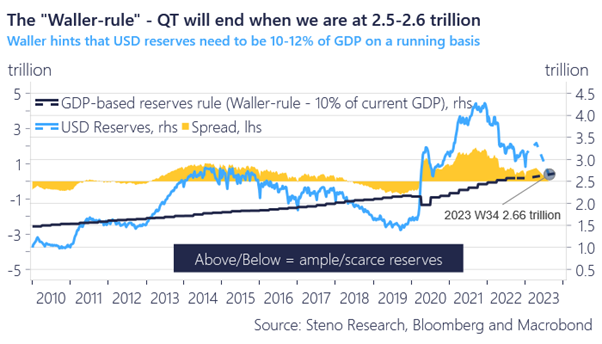

Let’s look at “The Waller Rule” introduced late last week by Christopher Waller from the FOMC. Waller said that the QT process will either have to slow or come to a complete halt, if the amount of USD reserves is equal to 10-11% of USD GDP, which is around 2.5 trillion USDs relative to current GDP (but rising over time obviously).

The rule also allows us to set up a scoring model. If USD reserves > 10-11% of GDP, the Fed will consider reserves ample and vice versa. As we currently have >3trn USDs reserves in the system, with more to be added due to the debt ceiling, we need a withdrawal of another $5-600bn before QT will end/slow in between week 34-40 on our calculations. If GDP flatlines, it would actually allow QT to run for longer, since it’s terminal value gauged by the economic activity in this framework. We find “the Waller rule” to be an example of the KITSS-principle (keep it too simple stupid) that we see implemented across many central banks.

Chart 1. Reserves are still AMPLE in the USD system

……………….

If the Fed is willing to bring reserves down to 10% of GDP, we should expect S&P 500 to bottom around 3250 in the second half of the year. In other words, new lows.

The Waller Rule is not good news ultimately, but for now let’s enjoy the liquidity added in February and March due to the debt ceiling. When a debt ceiling deal is signed, run for the hills.

This was a mini-extract of “Stenos Signals” from this weekend. If you want to understand “The Waller Rule” in details and how to play it, you can still use “substack20” to get 20% off on www.stenoresearch.com/subscribe/ until January 31

Step by step: How to become a part of the Steno Research team?

Choose one of our offered subscription-packages

Use our coupon substack20 to get 20% off your first purchase!

Become part of the best macro team on the globe

Subscribe here → https://stenoresearch.com/subscribe/

Chart 4. Stocks to bottom around 3250 in H2-2023 on “The Waller Rule”

to improve subscription rate, strongly consider offering either 1. free trial or 2. very low price for first 3 months, or , better still 3. option to cancel at any time. Helps overcome fear of committing $ to unknown products under the various subscription options. Do that and why WOULDN'T I give it a try?

Doesn’t the USD rise when the liquidity falls ?