Steno Signals #29 - Get ready for a historic EUR curve inversion

Is the EUR swap market prepared for what’s coming in 2023? We find that the market is yet to understand how hawkish Lagarde intends on being in Q1/Q2. Here is what our models tell us..

Happy New Year friends! Before we get to the letter of the week, I have a couple of important announcements to make.

First, this is the final Steno Signals editorial in front of the paywall here at Substack. As of this week we are starting to merge our research production/offering onto our new portal at www.stenoresearch.com. Stay tuned. We will announce more in the coming week or two.

Second, and most importantly for now, we will launch “The Energy Cable” on Substack in co-operation with the great Warren Pies and 3Fourteen Research. The Energy Cable will be the leading energy newsletter covering energy developments on both sides of the pond.

This is the first time energy is covered extensively from both American and European soil in the same publication, which makes it unique and maybe almost a necessity given the amount of regional stories unfolding in the energy markets both in the US and in Europe with global ramifications.

The Energy Cable will be released weekly and will contain model price signals in oil and natural gas every week, alongside curated content on the most important stories in the all important world of energy. You find The Energy Cable right here .. and it is available at a bargain price!

Back to this week's editorial..

Germany is the country in Europe, which has allocated the highest amount of subsidies as a percentage of GDP in order to tackle the energy crisis and any austerity loving bureaucrat at the German Treasury Department must be having some headaches at work these days.

Christian Lindner and company have agreed upon different subsidy measures totaling some 300 billion EUR to be handed out to needy households and corporations sooner rather than later. However, bureaucrats in Berlin are not the only ones suffering from headaches in Germany. In Frankfurt Christine Lagarde’s staff has projected core inflation at 4.2% in 2023, which must have been a cause for concern since Lagarde came out more hawkish than ever in the following presser.

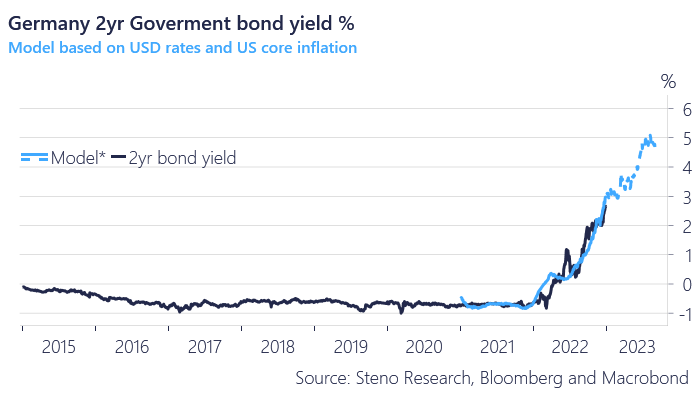

Chart 1: German 2yr Schatz yields to the moon?

Those hawkish tones were reflected in European STIR markets, which for instance saw a +25.4 bps daily increase in the 2y Schatz - A whopping 6 sigma move! If Lagarde follows Jay Powell’s playbook then rates must be hiked above core inflation to be in restrictive territory. There are good reasons to expect that EUR core inflation will lag USD core inflation by in between 5 and 7 months as for example wage dynamics are less flexible in Europe. Negotiated wages in Europe may hence play catch up to the US wage dynamics during H1-2023.

My model points to peak rates at around 5% in the 2yr German bond yield, which is even above where the 2yr US Treasury yield peaked a few months ago. The reason is that short-end EUR rates are even more beta-sensitive to a spike in core inflation with a lag than their USD peers, which may prove to be a surprise to many. The ECB could be gearing up to hawk up the malaise even more than the Fed has done.

While there is party in the short end, it is strictly business in the long end of the curve, where my model indicates a peak soon to come. My inflation based models may exaggerate the flattening potential in the EUR curve a bit, but I certainly buy the story that Lagarde and co are about to invert the beep out of the EUR curve. The ECB always commits a policy error during hiking cycles and this time will be no different.

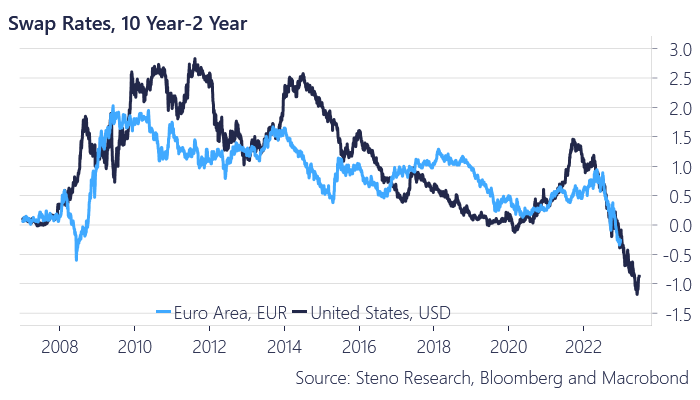

Chart 2: While the front end parties, the back end is strictly business!

Thus, given how keen Lagarde is on getting core inflation under control, we might be looking into an absolute monster yield inversion in Europe come spring time! If we use the US swap curve and let it lead Europe by 6 months, then we are looking at an inversion of some 100 bps at least!

2s10s flatteners in EUR is your European macro trade for H1-2023, unless you prefer to be an outright payer (short in bonds) in the front-end of the EUR swap curve. We need terminal rates / the cycle peak to price around at least 4.5% before Lagarde can claim victory and we are clearly not there yet.

Chart 3: The mother of all yield inversions in Europe?

There is a caveat, which hawks at the Bundesbank and other frugal economists in the Eurozone need to keep in mind though… Hiking rates in the EZ widens the BTP/Bund spread since Italian debt now commands a higher risk premium due to increasing credit risks.

Given the Eurozone’s construction with its asymmetries among member countries we might find ourselves in a ‘damned if you do, damned if you don’t’ scenario, where hiking or lowering rates equals the same inflationary outcome as an aggressive hiking cycle may end up weakening the Euro due to sovereign contagion risks.

The (many) EUR bulls better hope that the ECB’s bond purchasing program TPI lives up to the nickname I gave it: ‘Temporary protection of Italy’!

Chart 4: Achtung Achtung, hawks at the Bundesbank!

This leads me to the biggest positioning anomaly currently with more and more EUR longs being added, while the overwhelming consensus on equities is still bearish, which is still visible in a substantial net short position in the equity space among non-commercial participants in the futures market.

The positioning spread is now at historical extremes, which leads me to the following two conclusions: i) One of the two consensus trades (Long EUR and short S&P) will likely be wrongfooted and ii) This leaves a relatively good risk/reward in being net/net long US equity risk with a naked FX exposure seen from European soil.

Either equities will continue to sell off and you will get a cushion via a rebound in the USD or else equities rebound, while the EUR continues to be decently underpinned, but given that the short position in equities and the longs in EURUSD are both stretched, you may also end up winning on both legs. Worth the risk/reward in my humble opinion.

Chart 5: One of the largest positioning spreads between EURUSD and equities over the past decade… Worth utilizing as a European?

A widespread covid wave in China was always the only feasible trigger for a reopening

Despite the fact that Germany has been able to redirect some of their exports since China literally went offline, China remains among their most significant buyers. As one of the very few research shops globally, we explicitly wrote that the only feasible trigger for a Chinese reopening was a widespread Covid wave that killed all hopes of keeping the zero-covid policy intact.

A larger spread of the virus was hence to be seen as a factor increasing the probability of a Chinese reopening, in sharp contrast to what everyone else concluded and oh boy we were right. Using a cynical political framework to grasp the next steps in the covid handling has worked well for me over the past 2-3 years, even if it has cost me a shitstorm or two along the way.

Xi’s China has now effectively admitted defeat and abandoned the far-reaching restrictions, but could this change of policy be the lifebuoy the German economy, which we have put under the loop in this article, is longing for?

Turning to historical data, one compelling case would be that as the economic activity in China, presumably, picks up its pace due to the unshackled population returning to the assembly lines, German exports to China will follow suit. Historically, the two are closely correlated, as one would imagine, and the lag benign - the best correlation is obtained by allowing the Li Keqiang index (proxy for economic activity) to lead by two months.

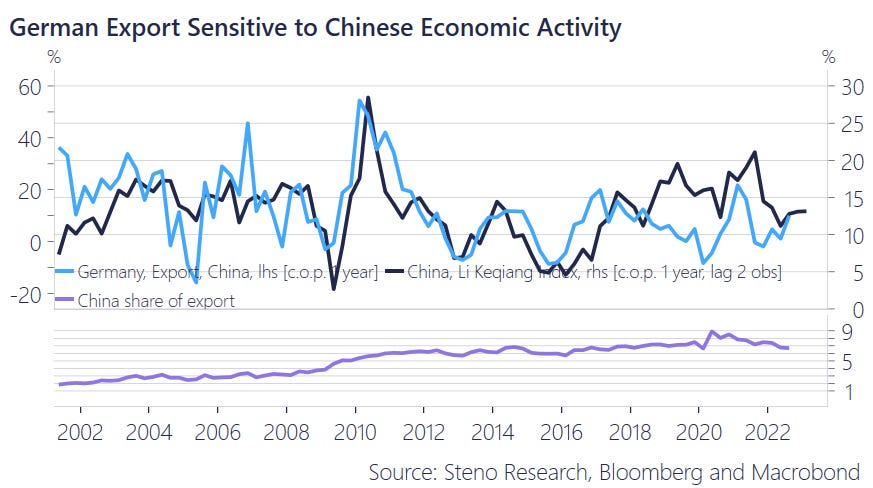

Chart 6: Where China goes, Germany follows a few months after

Held against late 2020-levels, export volumes from Germany to China are down some 40%. German cars haven’t shrunk or shredded weight in the span of the last 2-3 years nor have other goods - at least not to an extent which could explain the drop, why only the decade high inflation can explain the still decent German export numbers measured in EURs. The volume is down markedly. Price usually follows with a time lag.

The silver lining for Germany and its finances would be if China jump-started their production capacities. This could, ideally, simultaneously lower costs of imported goods (easing supply), and increase Chinese demand thus bidding up the value of the euro, but the question is whether one should bet on such a scenario already now as the reopening seems to be getting underway.

Chart 7: Inflation taints the picture

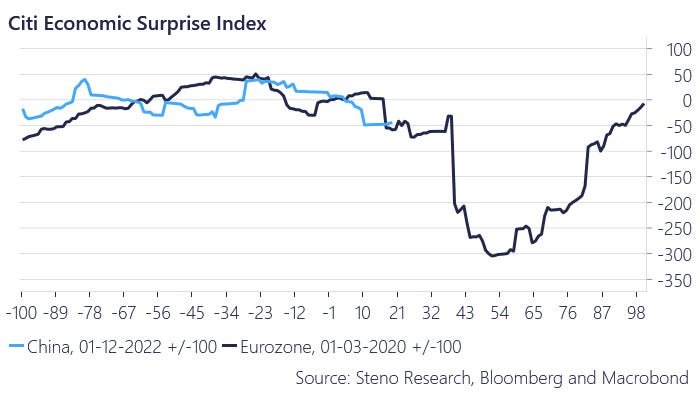

We find the following to be an underappreciated thesis on the Chinese reopening. A Chinese reopening will first lead to a negative economic surprise, before a HUGE positive surprise 3-4 months later.

We base that on the reopening playbook from the West in the spring of 2020 where key figures initially disappointed relative to consensus expectations. If everyone, their mother and dogs now find the reopening to be positive news, consensus estimates may end up being too optimistic in the near term in China, which ultimately may turn into a drag on the reopening bets (long EURUSD, long Copper and long Hang Seng to mention a few).

If the European playbook works for China, we may need to wait another 50-60 trading days before the REAL ketchup effect becomes visible and allows the reopening bets to regain momentum. Patience is key here..

Chart 8: “A Chinese reopening is immediate positive news”... Not so fast amigo

Energy as relevant as ever

In September, with the sabotage of NS1 and 2, bridges between Russia and ‘The West’ were officially burnt and the sudden hunt for gas and other fossil fuels turned almost primal in Europe. Storages were eventually filled - at high costs - though. The fact that China wasn’t demanding the usual quantity to uphold production may have actually been a blessing in disguise.

As we have become painfully aware here in Europe, not much happens without energy, and that unfortunately applies to China as well. We may expect some economic relief from the unfolding reopening, but we should also anticipate a major consumer of energy and industrial metals in particular returning to the table, adding further supply-pressure on the most essential, sought after, and hence inflationary goods.

Do not count your chickens just yet, even if energy admittedly looks soft both in commodity and equity space right now (I am tactically short in Energy).

Chart 9: China back at the table

For my Danish readers: We will host a live-event at Bremen Teater Feb 8 2023 - tickets are found right here -> https://allthingslive.dk/event/millardaerklubben-live

Best wishes for 2023 from Andreas Steno (andreassteno@stenoresearch.dk)

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

👍 Exactly the type of non consensus, geo-politically grounded, yet technically supported analysis (especially appreciate the insight on correlation and cycle lags) I am looking for.