Steno Signals #26 - Stealth QE through the back door?

Is it really a possible scenario that the Fed will do stealth-QE by summer 2023? And are equities still a sell based on USD liquidity plumbing? Get the answers here!

Financial plumbing is more important than ever.. We can explain most of the moves in equities this year with a proxy of USD liquidity, but let’s have a look at how we actually calculate USD liquidity and why various parts are moving.. Ultimately, I will look a bit ahead on inflation and the Fed for this week.. Enjoy!

The anchor - The size of Fed asset holdings

Since the Great Financial Crisis of ‘08, the Federal Reserve data show nothing but positive earnings in extra interest income for the central bank. This has much to do with its active role in the economic aftermath of the crisis. Since then its balance sheet has continuously expanded.

While most economists still in charge had yet to get acquainted with quantitative tightening and the practical effects of positive real rates and balance sheet tapering, J. Powell announced earlier this year that, in addition to raising policy rates, the Fed would trim its ‘portfolio’ as of 1st June 2022 with a max run-off of 95bn USDs per month. The ramifications of this policy change is now starting to surface on various balance sheet metrics..

Chart 1: From buying to tapering

The expansionary policy which has stimulated the economy basically since 2008 really took off when covid emerged in 2020. As the world and hence large parts of the economy went on indefinite hiatus, the Fed tried to counteract the hold-up by going on a buying frenzy. Such continuous expansionary policy is ought to lead to some inflation and possibly policy-driven asset price bubbles.

Especially with a war on European soil straining diplomatic ties between the West and Russia and de facto shutting down Russian supply of energy, not to mention the mulish handling of Covid in China.

The abundance - The reverse repo facility

During the spring of 2021 financial institutions started parking their funds at the Fed in exchange for securities - a way of safely getting rid of excess liquidity. As the Fed balance sheet was expanded and money in circulation grew at a stunning pace, institutions made use of the O/N RRP on an increasingly larger scale.

Through open market operations (OMO), the Fed uses repos and reverse repos to allow stability in funding markets. While repos provide money for the banking system, RRP’s ‘lend’ money from the system in return for collateral when there is an excess of reserves to collateral. This facility hence DRAINS liquidity from the financial system.

As the Fed tightens liquidity via QT, one ought to expect the usage of this facility to slowly but surely dissipate, but it is certainly a slower process than expected by many.. but how slow? Let’s have a look at it.

Chart 2: The overnight reverse repurchase agreements

Now, with QT well under way, we would expect institutions to sit on less excess liquidity and hence lower their demand for reverse repurchase agreements - and we are beginning to see a retracement in the volume of these.

A simple regression on ON RRP, given the historical relation to the total assets held by the Fed, indicates that the use of RRP should be around half a trillion less than current levels (a 25% decline)..

The same regression study hints of a withdrawal of roughly 0.47$ from the Reverse Repo Facility per 1$ the Fed withdraws via balance sheet runoffs (QT).. The RRP facility drawdown hence roughly sugarcoats or even annuls half of the intended liquidity tightening from QT.

Chart 3: Dollar volume in RRP remain elevated

The one outside of Fed control - Treasury General Account (TGA)

The US Treasury always sits on a portion of the available USD liquidity and recently they have released liquidity to the rest of the financial system via sitting on a smaller cash buffer than earlier this year.

The TGA is currently around 430bn, but the US Treasury aims at a level closer to $ 700bn as a new natural equilibrium after a bizarre jump when the “war chest” was filled during the pandemic.

This is a part of the USD liquidity landscape that is outside the Fed’s control as the US Treasury decides whether to increase or decrease the liquidity holdings of the US Treasury. The recent downturn in the TGA has ADDED to liquidity in the financial system (as the US Treasury holds less liquidity) and has counterbalanced the Fed QT efforts.

Chart 4: Treasury General Account

The newcomer - Remittances “The Fed is in the Red”

One of the most interesting stories in macro right now is the below chart of earnings remittances from the Fed to banks holding treasury reserves.

Since 2014, the Fed has paid remittances to the US Treasury as bonds held in the SOMA-portfolio (QE purchases) have yielded more than the interest the Fed has to pay to reserve banks on reserves held at the Fed. That equation is now upside down as the interest paid on excess reserves far exceeds the running inflows from bonds in the SOMA-portfolio.

The losses, which currently add up to around $12 bn per week, does impact the remittance, or rather lack of remittance, to the U.S. treasury. For now, the Fed can just decide to defer the liabilities but there might come a point where that is no longer politically palatable, but in any case this has an important bearing on USD liquidity.. If the Fed runs an operating loss, it basically means that the Fed “prints” USD reserves to pay interest on existing reserves. This is a liquidity ADDING mechanism of potentially as much as $250-300bn a year, which I have named the IOER-deficit.

So, even as the Fed withdraws up to $95bn via QT a month, the TGA, the RRP and the IOER-deficit currently drag in the opposite direction meaning that USD liquidity doesn’t tighten nearly as fast as promised.

Chart 5: Net negative remittances due to the U.S. Treasury

So, what are the takeaways?

The bottom-line is that USD liquidity dwindles much slower than anticipated, and it even increases temporarily due to TGA volatility around the mean.

If we look at the asset base, the TGA and the RRP projections based on the above studies and the US Treasury quarterly refunding report, we get a fair value of around 3500 in the S&P 500 by end-March 2023. It is not that bad, and the reason is that liquidity is not tightening as fast as expected by many. The RRP, the TGA and the IOER deficit currently sugarcoat the withdrawal of liquidity from QT.

Bottom-line? S&P 500 will likely re-test the lows around 3500, but it is not the end of the world for equities.

Chart 6: Our USD liquidity proxy model versus S&P 500

CPI week: 50 bps and done? Inflation outlook is pointing clearly down..

We have said over and over in recent months that inflation is rolling over hard and we continued convincing evidence of that thesis.

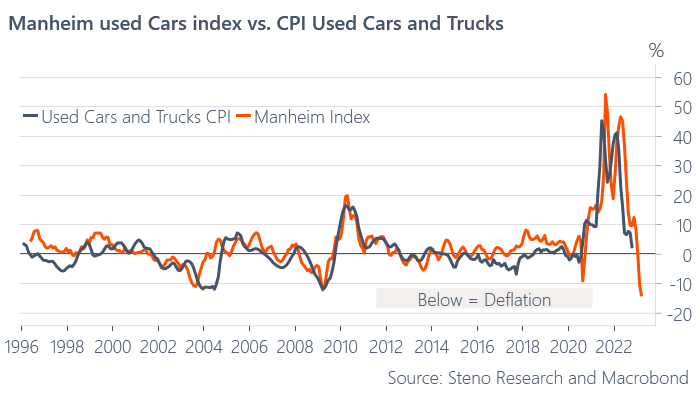

We need to remember that US CPI weights were updated in January on the back of two years of EXTREME over-spending on goods, meaning that goods inflation > services inflation relative to historical weights. Car prices are now dropping month on month for the fifth month running and food prices also look ripe to drop materially in this CPI report.

Bottom-line? Goods are likely to surprise to the downside!

Chart 7: Manheim indicator points to a sharp drop in car prices

A lot of people highlight how the PPI surprise (on the upside) is a warning signal for next week's CPI report.. I don’t think so.. The PPI report hints of sub 6% US inflation within a couple of months on usual correlations and as Powell has essentially discarded Shelter inflation as an important part of service inflation recently, this ought to have an impact on policy making into Q1.

Chart 8: US inflation in PPI and CPI terms.. CPI headed below 6% soon?

I am starting to convince myself of a 50 bp and done approach from the Fed as they get more and more confident that inflation is dropping towards target. This leaves a CLEAR risk of a double-top inflation picture emerging down the line, but that is not something to worry about in positioning for the next 3-6 months.

I tend to think that bonds look interesting (in particular in the short end of the belly) and that equities should remain a sell due to liquidity considerations (target zone 3550 in S&P 500), but imagine a scenario where the Fed ends QT already next summer, while keeping Fed Funds above 3-4%.. That would leave the Fed allowing STEALTH QE to happen via the IOER-deficit already in six months from now..

Maybe we are all too bearish on equities? And maybe we have too little gold in our portfolios?

Best wishes for the week..

Please visit www.stenoresearch.com to follow our developments - we have exciting news upcoming soon. If you are interested in an institutional coverage, please contact me directly at andreassteno@stenoresearch.dk - we are onboarding clients already now.

For my Danish readers: We will host a live-event at Bremen Teater Feb 8 2023 - tickets are found right here -> https://allthingslive.dk/event/millardaerklubben-live

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Ioer was replaced with iorb

Beginner question :) Doesn't the Repo account sitting at 2T cancel out with the RRP also at 2T ?