Steno Signals #21 – 3 reasons why everyone, Zuckerberg, me, and their dogs turn into idiots when rates are 0%

In my base-case, we are going to see a double-top inflation picture, but I sincerely hope that we don’t resummon our inner financial illiterates, if rates drop towards 0% due to temporary disinflation

I have been wanting to draft this article for a while, but it is just so much easier to be this honest, when I am now the master of my own little universe. Steno Research has been in the making for a while, but it feels good to finally set the team. I promise you that we will deliver 100% independent and thought-provoking insights very soon. You can follow the progress right here (https://stenoresearch.com/)

I have a concession. The 0% yield curve of 2020/2021 turned me into a financial imbecile temporarily. I guess a lot of you know the feeling. Large sudden returns, no whatsoever value of money in sight and high-fives all around the sectors I was employed in. It felt good. And even if I was probably one of the first strategists worldwide to call (and trade) the inflationary wave already during the early parts of 2021, I simply turned around on that view too early this year as I underestimated the QE driven animal spirit within myself and others.

Someone sent me this meme a few months ago, and it is probably the most telling meme I have seen in many years. This is what the current monetary policy is all about. The Fed is simply trying to restore sanity after a few years of zero-interest-rates insanity.

Why we all turned into financial illiterates due to zero interest rates

There are several reasons why zero (or even negative) interest rates are unhealthy. Let me provide you with a few practical -and anecdotal explanations from what I have observed over the past 2-4 years

1) The time value of money in a zero interest rate environment

The time value of money is a core principle in finance. Most, if not all, investment professionals have been taught that the value of money is larger today than tomorrow due to the yield potential in the interim. The DCF (discounted cash flow) model is consequently the first thing you brainwash right about every junior analyst with at every asset manager, pension fund or investment bank.

If you are to value a company or a project today, you discount future cash-flows with an appropriate discount yield to account for the time value of money in the expected cash flows of the company or the project. As soon as the traded “time value of money” – i.e. future nominal bond yields - are zero or even negative, right about every project can be justified, no matter how idiotic it is. Something that Elon Musk has made good use of.

If the time value of money is zero or even negative, even a forecasted rapidly growing cash-flow from selling Rocketship trips to Mars in 2340 looks compelling. This is not healthy. And I can guarantee you that most investment professionals that I have worked with did not consider the “what if’s” of using a non-existent time value of money in financial modeling through 2020/2021. In hindsight, this almost seemed like a mass psychosis to me.

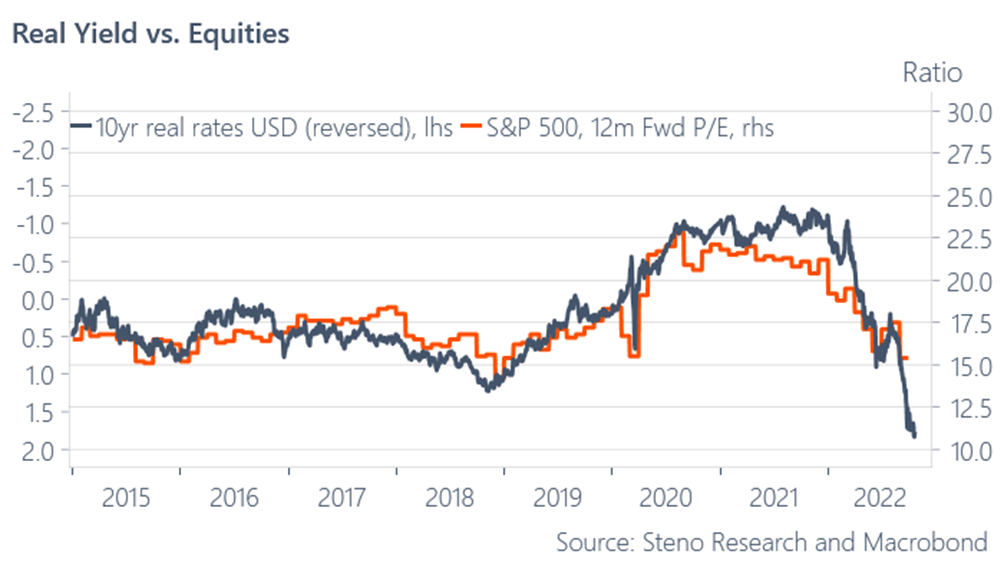

Chart 1. Zero interest rates led to ABNORMOUS traded P/E multiples (in particular in tech)

2) Creative destruction goes to zero when rates go to zero

When money literally carries no time value, we tend to see an environment of extremely low productivity growth. Pseudo-projects suddenly seem compelling as there is no truly extra economic value-add in projects leading to efficiency gains quicker than others and bad ideas hence thrive. Take the idea of the metaverse. Its launch was probably advanced by the zero interest rate environment and as a consequence Meta and Mark Zuckerberg are now pissing away decent cash-flows on a project that no-one cares about during a cost of living crisis.The Metaverse may be a good idea, but the only true litmus-test of such an idea is an environment with a (substantially) positive time value of money.

When the cost of loan financing approaches zero, it also means that companies struggling to generate any free cash flows continue to survive. The amount of “zombie-companies” being IPOed reached all-time highs during 2020/2021 consequently.

When the tide turns on financing costs, you will find out who was swimming naked. Thankfully, I was at least wearing speedos due to a couple of solid inflation hedges against the zero-interest rate regime. This is what it is all about over the next 2-3 quarters. Who will go bankrupt and who will not? It is time for creative destruction again, and that is not a bad thing.

The numerous Covid aid packages is another example of the direct consequence of zero interest rates on productivity. Paying business to temporarily shut down, and paying people to stay at home, is about as unproductive as it gets - especially when these lock downs proved to be far too lengthy. My feeling is that lockdowns would have been a lot more targeted and a lot shorter, if interest rates would have been higher.

Chart 2. When rates go to zero, negative productivity growth follows

3) Politicians begin to act as if they were entrepreneurs when rates go to zero

The third issue of zero interest rates is related to the second on creative destruction. When rates go to zero, politicians start taking decisions as if they were successful entrepreneurs. They are obviously not, because they would never have picked a political career in that case.

During 2020 and 2021, we saw numerous pseudo-projects on ESG being launched by politicians across the West. With no time value of government debt, it suddenly becomes very tempting to try and pick the long-term winners via public financing. Truckloads of public (and private) money were thrown at non-commercial ESG projects at the expense of short-term viable energy projects. The consequence is currently clear – we are stuck with energy scarcity due to a lack of short-term investments in oil, gas, and other fossils that we are yet not able to (fully) replace.

I am obviously FOR the transition towards carbon neutrality, but we have better odds at succeeding, if rates are above 0% - as the right projects are more likely to get the right funding.

Chart 3. We are still using more and more fossil fuels year after year

Even if the zero-interest-rate policy is hopefully dead and buried by now, I would not rule out that we start discussing (much) lower interest rates again during 2023/2024 due to the upcoming recession. Most, if not all, of my inflation indicators point to substantial disinflation in 2023, which is likely to reignite the discussion of rate cuts and central bank pivots.

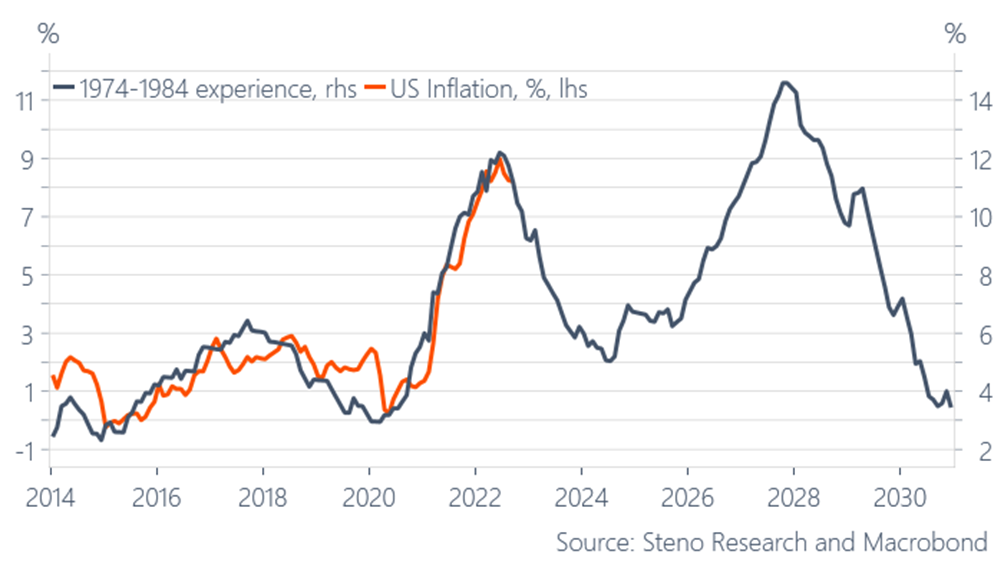

BUT! … We have never had inflation running at current levels without experiencing a so-called double top inflation regime. That was the case in 1974-1980 and in 1946-1951. The reason is simple. As soon as disinflationary trends get clearer and clearer, everybody (including politicians) will be screaming at the Fed and the ECB to pivot. Central banks will likely cave in under immense external pressure, no matter what they are saying currently. Just look how intensively we have discussed the central bank pivot over and over this year, and most asset managers, pension funds and investment banks still hope and pray that the pivot will arrive due to their asset allocation, which is still mostly based on observed trends from 2008-2021.

Chart 4. We have always seen double tops in inflation, once inflation gets as hot as it is now

Markets will consequently likely try and chase the zero time value of money narrative once more over the next few years, before the next inflation wave kicks in. The smart investor ignores it and ensures that the portfolio is sufficiently inflation protected for the decade ahead. I will do my best not to turn into a financial illiterate again this time.

I do not doubt exponential technological advances. I do not doubt human progress, but I doubt that a 0% interest rate regime is a clever idea. Such a regime turns us into idiots.

You can follow our journey at https://stenoresearch.com/ - news will arrive soon.

Best of luck from Andreas

That's a seminal article, Andreas

Thank you very much.

What's your idea of a fair P/E multiple in the current regime, also considering the real yield vs equities chart?

bang on Andreas, 0% interest rates make exactly zero sense