Steno Signals #20 - NO soft landing unless central banks admit to disinflation

It is hard to find a single inflation indicator not rolling over, but there is ONE and that will be tricky to handle for the Fed. Meanwhile, European energy supplies are MUCH better than feared!

Looking through my catalogue of forward-looking models I struggle to find any which do not indicate inflation coming down. Yet we see no signs of central banks slowing down as they seem to fear a ‘74 Arthur Burns-like scenario.

With the unwavering - boarderlining stubborn - objective of tightening until demand is crushed, it becomes harder and harder to opt in on the soft-landing (fairy)tale. Will the FED regain its credibility and pull off a ‘Sully’-like landing? I believe it when I see it.

Meanwhile gas- and electricity prices keep falling in Europe and we have more of the same in store for us over the coming month or so in sharp contrast to the anglo-saxon doom and gloom reporting on Europe.

Let’s start the newsletter with an overview of some of my inflation indicators across important categories

Food - The staple’st of staples

Consumers around the globe, particularly in Europe, are displeased with current price levels due to recent surges in inflation - said diplomatically. The daily grocery shopping has become cumbersome for the most exposed and worst off financially. Luckily we see indications of some relief. Food-commodity prices are coming down quite sharply lately. The ‘FAO Food Price Index’ has come down roughly 15%, and given its close correlation and historical lag, it is due to impact the corresponding CPI - ultimately easing pressures on the end-consumer.

Chart 1: Commodities (food index) lead CPI (food and beverages)

Goods - PCE and Freight interlinked

Remember the supply chain crisis that everyone talked about in 2021? Yep, it feels long gone, and it honestly is long gone, if you allow freight rates to gauge the supply chain pressures. Freight rates matter for the price of most goods due to longer and longer supply chains having been built up through the globalization era.

Domestic (US) freight rates have come down sharply and they have a lead time of 3-4 months on the PCE Goods inflation index. Goods disinflation on local goods is coming up.. but what about goods produced in China?

Chart 2: Domestic freight rates versus goods

International freight rates, using Shanghai as a proxy, have fallen off a cliff bringing them down to the vicinity of 2020-levels. Imports of consumer goods to the US were worth 903.5bn USD in 2020 (37.5% of imports), and roughly 30% came from China, Japan or Germany. Adding the close correlation with goods-PCE to that, I don’t think it’s unreasonable to expect a matching decline in PCE and thus a spill over in headline CPI. Material disinflation on goods coming from China is on the cards soon.

Chart 3: International freight rates versus goods

Wages and job openings - two sides of same coin

Having covered developments in costs of food and goods, let’s have a closer look at the development in wages and job openings. Is there a risk of a so-called wage/price spiral?

Job openings remain sky-high in the US, but they are far less elevated than the headline number suggests. Due to the work-from-home trend seen through the pandemic, companies have to post a job opening for the same job in various locations to ensure that the talent pool is exploited. This is a KEY reason behind the number of openings currently posted - a lot of double-counting.

Wages tend to follow openings, and if I am right on my double-counting thesis, then wages ought to follow openings sharply lower in 2023. So much for a wage-to-price spiral risk.

As wages currently cannot keep up relative to inflation, purchasing power is crushed, further decreasing demand for goods and services in the real economy. We now see companies warning halts to recruitment or even layoffs - my prediction is that we will see a sharp increase in unemployment in 2023 as the economy heads for recession.

Chart 4: Wages versus job openings

Shelter/housing costs - the odd one out

Cost of shelter is notoriously complex to approximate, and with the definition of ‘Owner’s equivalent rent’ (OER) the data is bound to be skewed. What is even trickier with the housing component of the CPI-basket, is its lag.

There is still a BIG gap between observed (Zillow) and surveyed rents with the latter being used in the CPI and we have recently seen how shelter/housing has been THE main driver of US inflation. Surveyed rents tend to lag the actual housing market by 12-18 months, which is an issue that the Fed is aware of, but yet refrain from admitting fully to in policy making. This rear-view-mirror-navigation poses a material risk to CB’s ‘overdoing it’.

Chart 5: Shelter costs have plenty of pick-up

When charting the derivative, i.e. the pace of the rent increase, we see that the observed rents are now fading fast, while the surveyed rent in the CPI is still increasing.

In other words, the only component currently truly driving up the CPI, is basically already falling, but it is just not reflected in the current methodology.

Chart 6: Diminishing rent increase

Central Banks

In 1971 the US abandoned the gold standard, partly to curb inflation. Since the transition to fiat currency, central banks have had a key role in ensuring price stability and helping manage economic fluctuations. Unfortunately, we learned during the 70’s that price stability could be hard to reign. Nevertheless, CB’s do indeed influence, if not decide, the path of the economy and especially equities. They have the control of the economic gear lever, trying to dictate the economic activity using debatable indicators - forward- and backward looking.

The Fed is currently mostly steering the wheel through the rear-view-mirror, which has been further emphasized by the move to full on data-dependency with almost no weight given to forecasting since September 2020. They made a mistake on the way up (on inflation) and they will make a mistake on the way down (on inflation).

Chart 7: Central banks decide the path ahead for equities - will they allow 1974 to replay itself? Likely not…

With positive real yields, liquidity is withdrawn from the real economy, and from equities in particular. As a rule of thumb; the riskier the asset the more sensitivity to positive real yields.

The low interest environment of the past decade has levered up the economy including companies, with the promise of increasing returns. Now we see rapidly rising rates, and as debt becomes expensive to maintain, equities devalue equally rapidly. If the tide does not turn and offer relief, we could be in for an outright massacre of risk assets - including equities.

The central banks continue to move ahead with forward tightening despite inflation expectations dropping and forward looking inflation gauges all telling a story of slowing inflation. This is why real rates continue to increase. Where real rates go, forward P/Es follow. A forward P/E of 11-12 is now warranted given the real rate levels, which should take the S&P 500 to 2600-2700 on unchanged earnings assumptions - ouch!

Chart 8: Real rates versus equities (12m Fwd P/E)

Well, with that doom and gloom, it is time for a bit of brighter news out of Europe. Energy prices are falling and the winter ahead of us looks better than feared by many. Here is why!

Energy prices in Europe are falling from the sky

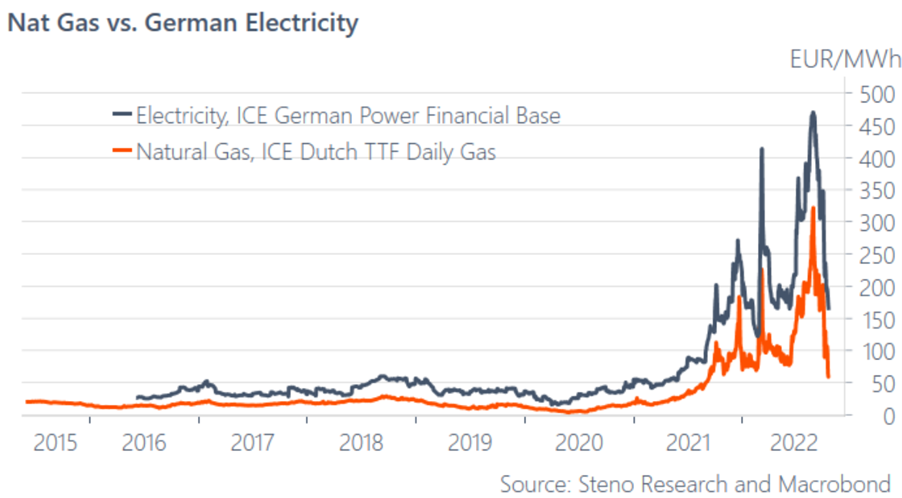

In Europe we are starting to see the absolut crazy price levels in natural gas and electricity cooling off. Natural gas prices have dropped from >300 EURs per MWh to levels just north of 50 EURs and day ahead prices are even lower in many areas of Europe. Even though this will not be reflected on the bill of households and corporations immediately, this is still great news going into the heating season. Furthermore we have had a warm October allowing storages to remain very high.

Chart 9: Nat Gas & Electricity dropping like a stone

Prices in Spain have dropped as low as 27 EURs per MWh for natural gas as there is currently a queue of ships waiting to off-load outside of Spanish LNG ports with fill-levels in European storages already close to 100% way ahead of schedule.

It seems as if everyone mail-ordered natural gas at the same time a couple of months back and now all the sudden there is no way to store all of the mail-orders… I would NOT be surprised, if spot natural gas prices went very close to zero in the weeks ahead due to a bizarre over-supply short-term.

I have been talking about this issue over the past 6-8 weeks, while most other pundits were stuck in doom-mongering about the supply for this winter.

Chart 10: Fill levels are WAY ahead of schedule in Europe

Interestingly, the futures curve has a positive beta to spot developments, which means that even if the price action is currently driven by a short-term oversupply, it brings the ENTIRE curve down with it. This is not particularly rational, but that is often how a market works. The best trade is hence probably to fade December or January contracts for TTF natural gas still and look for a reversal in 1-1.5 months from now.

Chart 11: When the spot price drops, the entire curve follows

It also seems like Europeans are listening to calls asking them to save heating and electricity. Through September and October German households have saved 20% or more on their gas consumption compared to last year. This lowering of demand is also necessary given the market's expectation of a pick up in prices over the next months..

For now, given that 1) flows are solid, 2) temperatures are hotter than usual and 3) storages are already full, we should expect prices to continue towards zero in the coming weeks.

Through November, the net-injection into storages typically flips due to the heating season commencing, which will allow for a bigger net spot demand for natural gas, but we can call off the worst case scenarios for this winter. 2023 supply is now the issue that we need to discuss.

Chart 12: There is still a solid net injection into storages in Germany through mid October

The 2023 supply is much less certain! LNG makes up 40% of the current supply of gas in Europe, but we are still running 20-25% below usual flow levels due to the lack of Russian gas. This is likely not an issue this year, but how are we going to replace 25% of the total gas flow throughout 2023 without big political moves?

Chart 13: Current source of flows of gas to Europe

The winter just ahead of us seems to be save, but in 2023 we may be in for renewed turbulence in Europe unless politicians wake up to the reality, but thankfully they have solved the test right in front of us and probably even overdone it to the extent where we now see OVER-supply of natural gas short-term. Interesting times indeed.

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

The Fed is well aware CPI is lagging. They are tightening aggressively such that inflation can be firmly defeated. They are also well aware that any prices which are rolling over can easily resume an upward trend if victory is declared too soon. The fate of financial assets is a distant concern relative to restoring the low & stable inflation environment that enabled the boom of the last few decades.

Good call on the European energy situation. Thank you for your thoughts!