Steno Signals #198 – A 20–25% Weaker USD May Solve All Trump’s Problems

The move in the USD is probably only getting started and a continuation of the trend aligns well with Trump's strategic initiatives on all fronts. The elephant in the room is if China will accept it.

Morning from Europe.

Trump's classical stop-and-go approach to negotiations is starting to get baked into markets, but we're still surprised by the extent of market moves when these impulsive threats are announced on Truth Social — and markets remain poor at assessing the “realistic outcomes” of this approach.

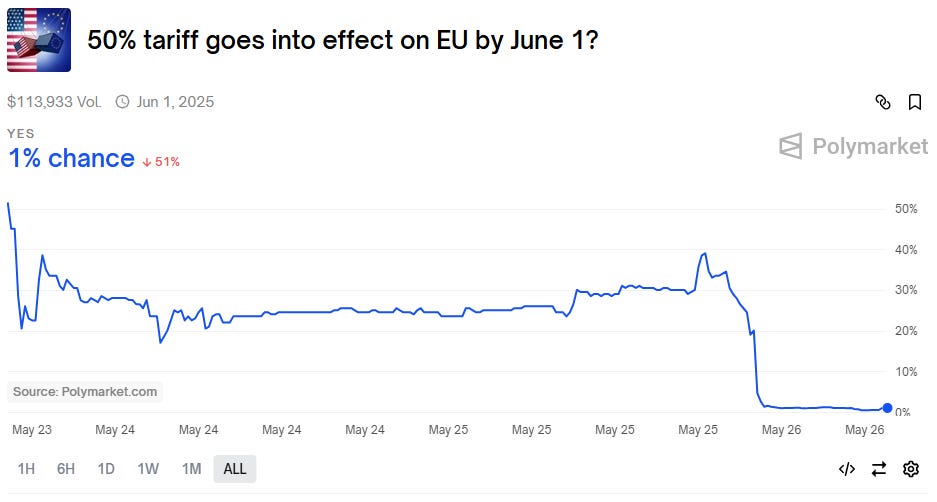

On Friday, markets at one point priced in a 40–60% probability that 50% tariffs on the EU would actually take effect on June 1. But after a phone call on Sunday, we can now consider those threats another nothing-burger. Markets accordingly have to reprice a lot higher during the day today.

We see a couple of clear takeaways from the market reaction—and the subsequent repricing in early Monday trading—to these tariff threats. The stop-and-go policy is USD-negative (probably by intent), and as the dust settles, it continues to underpin debasement bets, which is likely also somewhat accepted by the administration, now that it has a vested interest in keeping non-fiat bets elevated.

That’s why we think a 20–25% weaker USD may be the strategic target for the administration—even if Bessent claims the USD isn’t weak, but rather that other currencies are strong. Here's why a much weaker USD would solve a lot of strategic objectives for the Trump administration.

Chart of the week: The market remains very bad at pricing realistic tariffs outcomes

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.