Steno Signals #196 - What’s next for inflation given the US/China pause?

With all reciprocal tariffs now “paused” at lower levels, the next major battleground is inflation. Will inflation move lower, and will that allow for a further easing of financial conditions?

On the heels of the US/China "pause" announcement in the trade war, here's a quick take on market implications and what to watch next:

The initial market reaction has probably been more muted than many anticipated. Bond yields ticked slightly higher, gold softened, and there were modest tailwinds for regions and countries previously hammered by tariff exposure following yesterday’s “deal” in Geneva. But beneath the surface, several dynamics warrant a closer look.

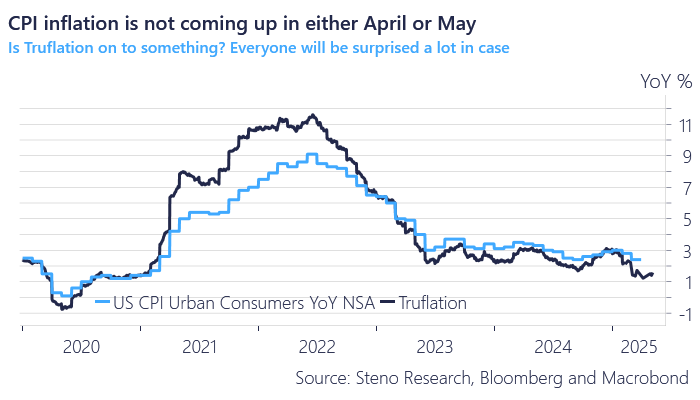

First, a glaring gap remains between how Washington and Beijing are framing the agreement—suggesting that the devil will be in the details, and only then might markets truly price in the implications. Second, Europe may be the quiet loser here. Not only does the region see few direct benefits from this thaw, but with the euro (and Euro-zone assets) sitting as a consensus long, it risks being on the wrong side of the next macro rotation. Third, there's a growing question around inflation expectations. Tariffs were widely expected to be inflationary, but with many now being rolled back or paused, and Wednesday’s CPI data likely to surprise on the soft side, the inflation narrative may have to be repriced downward. Compounding this is Trump’s "BIG ANNOUNCEMENT" on drug prices—another potential deflationary impulse.

Ultimately, this feels like a case of geopolitical and economic damage control. The U.S. likely cannot afford the strain of high tariffs as new cargo shipments arrive in a matter of days, while China appears reluctant to reengage stimulus efforts without a face-saving deal in hand. The broader takeaway may be that the U.S. is using this moment not just to cool tensions with China, but to reorient its trade agenda globally—lowering tariffs as part of a broader strategic realignment. Whatever the motive, it’s clearly a win for risk assets and a headwind for bonds, no matter how you slice it, but the next big battleground is on inflation now that the growth/trade question seems to be settled.

All inflation surveys have been “pumped” by tariffs levels that were always unsustainable, and while bond yields started pricing in a recession risk (due to tariffs), they also continue to price in an elevated inflation picture of >3% inflation for the foreseeable future. That is most likely going to be proven wrong.

Chart 1: CPI inflation to come down?

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.