Steno Signals #186 - The year of the weak USD is upon us

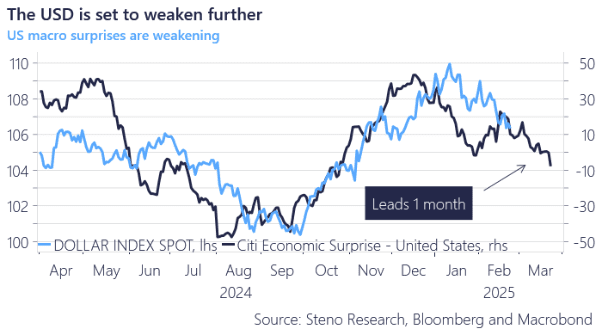

The tariffs are largely priced in, and there are early signs of a “race to the bottom” as Trump’s reciprocal approach prompts countermeasures. Meanwhile, US macro surprises are weakening.

I wanted to get the German election results before releasing my weekly editorial, and as far as I can judge, we are talking about a middle-of-the-road outcome, which should be seen as a net positive for European assets for now.

CDU (Conservatives) and SPD (Social Democrats) will be able to form a GroKo (Grand Coalition) with 328 mandates, which is a coalition that could likely find some common ground around spending more and removing the debt brake, at least temporarily. A permanent removal of the debt brake will require the backing of an additional party. This is much needed for Germany, which is still stuck in a low-spending, low-consuming, macro environment after the catastrophic energy policy pursued over the past handful of years.

In the meantime, we are starting to see softer key figures coming out of the US, exactly as we had anticipated. The Services PMI dropped below 50 on Friday, a week after a very soft retail sales report, and even if the medium-term effects are likely positive, we are in no doubt starting to see the effects of the DOGE-lay-offs in the sentiment. Even if the base-case is a lay-off spree of around 3-400k federal workers, they may take 1-2 contractors with them, leaving the total impact on employment upwards of 1 million, which is substantial addition to the 7 million unemployed currently.

2025 is shaping up to be the year of a weak USD as 1) markets are already SUPER long USD, 2) a tariffs premium has already been priced in and 3) the US is on a trend basis softening due to the DOGE-impact on spending and sentiment.

Chart of the week: A weak USD is on the cards in 2025

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.