Steno Signals #179: A handful of trades for 2025

Here’s a look at 2025 and how to trade macro. The short-term outlook remains heavily dependent on the debt ceiling, but there are reasons to be optimistic about risk assets in 2025.

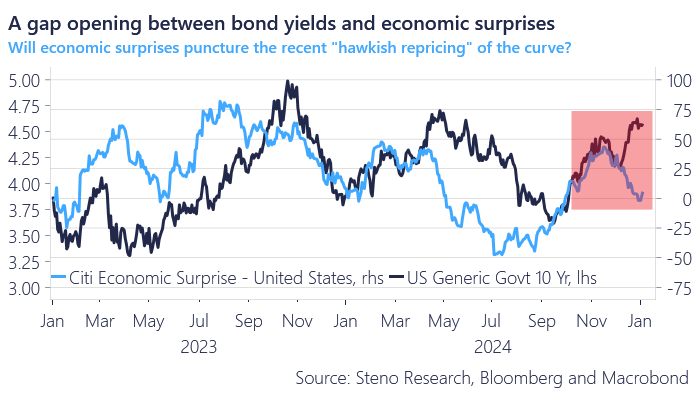

Happy Sunday, and welcome to our weekly editorial on all things macro markets. In full transparency, we’ve been a few weeks early on our bet for lower bond yields, which slightly wrongfooted our risk asset view heading into Chris

tmas—after being on a remarkable roll for several months.

We remain puzzled by the resilience of bond yields (and the USD) despite softer economic surprises and flattening inflation expectations. This is occurring even as media outlets and pundits continue to discuss rising inflation. Perhaps this resilience is primarily driven by the front-loading of duration issuance ahead of the debt ceiling being effectively back in force in 10–12 days (although it is already officially back in force).

On a brighter note, we’re observing the first signs of a liquidity relief post-New Year celebrations. The risk asset melt-up on Friday could be a positive harbinger for January. However, a strong USD continues to hold back the risk asset space from achieving a new all-time high.

Of course, we couldn’t pass up the opportunity to make some 2025 predictions—knowing full well they might prove wrong as early as Q1. Unlike investment banks, we prefer to release our trades in the year they pertain to, avoiding the temptation to flip-flop on year-ahead calls before the year has even started.

To make our predictions more actionable, we’ve also attached a trade idea to concretely express each forecast.

Trade 1: More US cuts for 2025 than anticipated by many?

Jay Powell surprised everyone just before Christmas by shifting the Fed’s focus from the labor market back to inflation. As we head into 2025, markets are currently pricing in 1.5 rate cuts for the year. We believe this projection is too conservative.

Firstly, the labor market seems poised to regain attention early next year. Hiring has essentially ground to a halt, and historically, this trend is often followed by an uptick in layoffs.

Secondly, significant pressure may come from the Trump administration, potentially pushing Powell and the Fed to cut rates. Lowering interest rates would help ease federal debt servicing costs, aligning with Scott Bessent’s goal of reducing the deficit to 3% of nominal GDP.

Thirdly, the momentum from the Inflation Reduction Act (IRA) and the AI boom over the past couple of years appears to be waning. Without a new driver of growth, we expect a convergence between private housing and construction payrolls.

Additionally, concerns over tariffs and a stronger USD may be overstated. Trump’s focus seems to be on supporting U.S. manufacturing, the stock market, and the broader economy—all of which would benefit from a weaker dollar. Interestingly, Javier Milei recently shared in a podcast that he views Trump as a proponent of free trade, suggesting that Trump’s use of tariffs may primarily serve as a negotiation tactic this time around.

Milei has reportedly been in frequent contact with Trump and his administration over the past few months. Perhaps his insights are worth considering. Overall, we are witnessing a tech-bro coup d’état unfolding before our eyes. Don’t midcycle that. Going long on SFRZ5 is a solid proxy for being bullish on all sorts of tech-linked assets this year as well.

Trade: Long SFRZ5

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.