Steno Signals #178 - Brace yourselves, liquidity is coming!

Contrary to the current prevailing consensus, liquidity appears poised to improve significantly during January. The debt ceiling dynamics play a crucial role as they directly influence the FOMC.

Happy New Year, friends, and welcome back to the Steno Signals editorials! My apologies for the silence over the past few days—I celebrated New Year’s Eve (and my 35th birthday) battling a nasty pneumonia, which has taken some time to recover from. Thankfully, I am finally better and wanted to share my 2025 thoughts on liquidity with you, as I find myself disagreeing quite a bit with the current semi-bearish consensus.

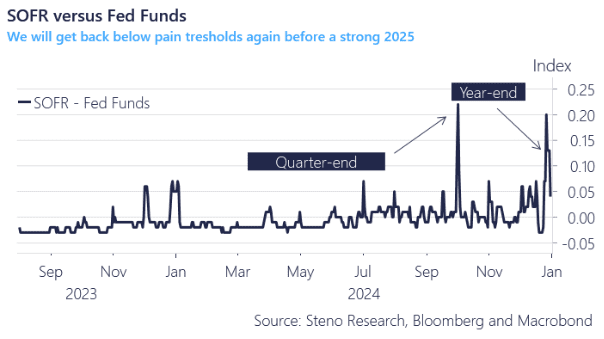

We experienced an almost equally “tight” year-end as the tight quarter-end back in September. Once again, we saw very wide SOFR-Fed Funds spreads, signaling that private repo markets are exhausted of capacity due to window-dressing and the implied liquidity withdrawal as banks and funds place money at the Fed during the year-turn rather than in money markets.

This quarter-end pattern, which is considerably worse than in 2023, serves as the first “warning” that we are nearing pain levels in overall liquidity availability within the USD system. The Fed is already aware of this and is likely at the “final stop” before introducing meaningful liquidity measures during 2025, given the life-cycle of liquidity that I will introduce below.

Chart 1: Another tight quarter/year-end

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.