Steno Signals #126 - Where did all the liquidity go?

The liquidity situation remains tight, and this cycle continues to defy the norm. Will activity and inflation return before Powell and his peers truly get the chance to inject liquidity again?

Happy Sunday, everyone!

This our weekly editorial with bits and pieces from our work at Steno Research and our strategy at Asgard-Steno Global Macro Fund (www.stenoglobalmacro.com)

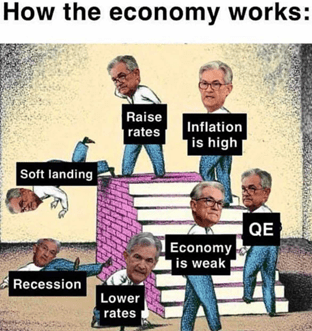

If you can’t show it in a meme, then it’s not true. That’s my modus operandi in the research business, and I stumbled upon this tremendous meme of the business cycle and how JPoww and his ilk respond to it.

This has been the Fed's operating model for a while: exaggerating the business cycle in both directions. The cycle itself is mostly dead—if we set aside the credit markets, which have been the main drivers of growth, especially when China was also firing on all credit cylinders

The issue with this cycle is that it hasn’t followed the typical playbook. We’ve kind of lacked a recession. 2022 felt like a recession in many ways, but we didn’t get one. Now Powell and his team are lowering rates into what appears to be an economy already rebounding, something we’ve alluded to throughout the year.

Does this wreak havoc with the QE playbook, which is typically the next step in the Fed-fueled business cycle? It’s certainly not as straightforward to assess as we’ve otherwise gotten accustomed to.

Here is our current reading of the situation!

Meme of the week: The wheel of the Fed-fuelled business cycle

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.