Steno Editorial: Is China your only feasible savior in 2023?

China is rebounding from a Lehman like credit event in 2022, which makes Chinese assets the cheapest on earth. Buying Chinese assets with a link to China may prove to be your only option for 2023.

This editorial is a free part of our “China Week” coverage on www.stenoresearch.com

*** Remember that we offer a FREE 2 week trial for our entire offering at https://stenoresearch.com/subscribe/ ***

The global economic cycle has never been more decoupled than right now in newer economic history. Chinese and US rate cycles have typically moved in tandem since 2008, but the decoupling of cycles has been outright stunning since the pandemic began in 2020.

The rates cycle is obviously a headwind for investors in all western markets currently, which is why this decoupling is of major relevance from an asset allocation perspective.

We have covered China extensively through our “China Week” and find reasons to believe that China is the only reasonable savior for portfolios during 2023. Here is why!

Chart 1. The cycles have decoupled

If Chinese trends from both a fiscal and monetary perspective remain much more benign than western counterparts, China is the one to watch from a growth perspective in 2023 as a Chinese growth story holds the potential to wreak havoc with the Western consensus.

Is the Chinese reopening momentum for example strong enough to reignite the global manufacturing cycle despite strong headwinds from tighter monetary conditions in Europe and the US.

Chart 2. China to the rescue?

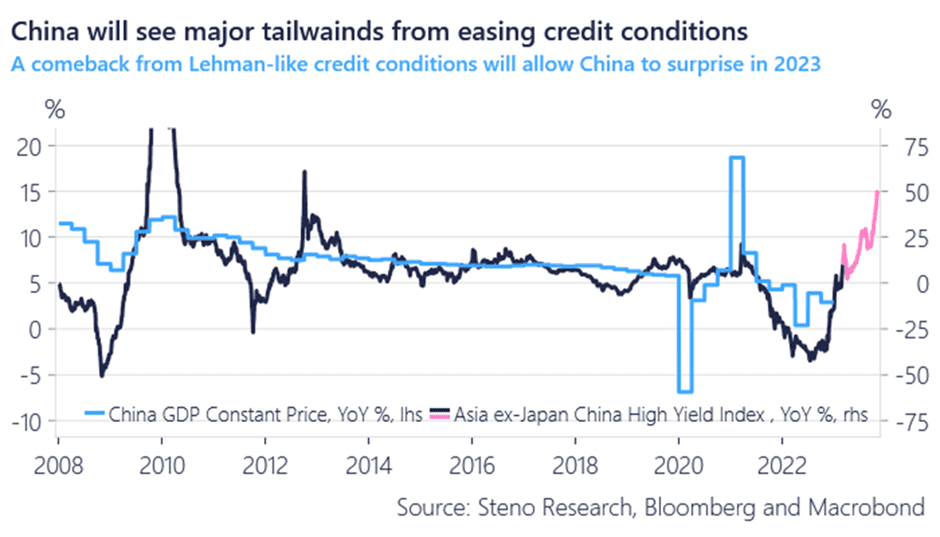

China is undoubtedly going to rebound markedly this year compared to a lackluster 2022. Not only will the reopening lead to a natural rebound in services demand in the economy, but China is also recovering from an almost Lehman-like credit event in 2021/2022.

The drawdown in credit markets was outrageous in China in 2021/2022 and the accumulated drawdown (spread widening) in Chinese credit resembled the 2008 crisis, and in some instances, it was even worse. Credit has stabilized markedly since the first signs of the Chinese reopening in November last year and most major credit have more than doubled since.

This is a huge sequential improvement in credit conditions, which is undoubtedly going to fuel credit growth relative to 2022 in China. The rebound from a credit-event is typically extremely strong and broad-based as in late 2009 / early 2010 and late 2012 / early 2023.

We may be underestimating the rebound potential in China should the authorities continue to underpin credit and increase attempts to restore calm in Chinese funding markets as they have been busy doing since late last year.

Chart 3. Chinese credit conditions have eased markedly in recent months

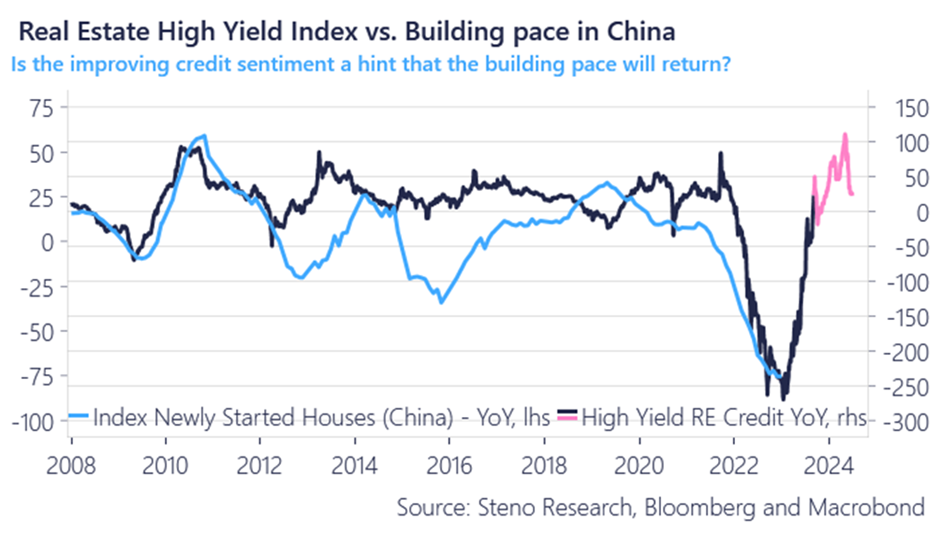

Credit conditions in Real Estate lead the building pace in China by 2-3 quarters, why the most recent easing of conditions is likely going to spill-over to a major rebound in the building pace in China towards the second half of the year. Right when the US economy is (still) expected to enter a major economic downturn.

This is the biggest sequential improvement to Chinese Real Estate credit conditions in recent economic history, which arguably holds the potential to surprise everyone and their mother on the positive side during 2023.

Building pace up 50% YoY in just a few quarters from now? Not unlikely.

Chart 4. Chinese Real Estate credit conditions have eased markedly lately

Chinese assets no longer look expensive after a few outright disastrous years in credit- and equity space through 2021/2022. Chinese equity P/Es trade with a substantial discount to median P/E values and there is no significant fiscal- or monetary headwind for Chinese equities relative to US or European equities.

European assets still look cheaper than Chinese peers from a P/E perspective, why European countries with a link to the Manufacturing cycle and China may be worthwhile considering as proxy bets on a positive Chinese growth surprise.

Chart 5. Chinese equities trade with a discount to median values

If we assess equities from a risk premia perspective, China poses a great candidate for an overweight status in a global equity portfolio. China is about to overtake the downward spiraling Europe on the #1 spot in equity risk premiums. Chinese markets are where investors are second best compensated for bearing the embedded risk relative to risk free real rates.

This premium is primarily driven by looser financial/credit conditions, why one should beware of potential alterations to policy – not least if inflation were to hit domestically in China. So far, there are no signs of such.

In any case, the US market looks extremely expensive from a risk premia perspective compared to global peers and the gap is widening. As Jay Powell has summoned his inner hawk again, it may be worthwhile looking for opportunities outside of US borders and the Chinese rebound potential in 2023 is material.

Whether you want to invest directly in Chinese equities depends on both moral- and economic considerations. Proxies such as equity markets in Chile, Australia, Germany, Mexico and Poland may also work in your favor this year, if China rebounds to the extent predicted by our indicators of easing credit conditions.

If you want to learn more about the risk of sanctions on Chinese investments, read our Geopolitical risk analysis here.

Chart 6. China is soon the cheapest equity market on earth

*** Remember that we offer a FREE 2 week trial for our entire offering at https://stenoresearch.com/subscribe/ ***