Something for your Espresso: Bye bye to AT1 investors

The Fed is likely to hike on Wednesday even if markets are screaming that they should rather cut. The first stages of the crisis playbook are playing out. The next will be pivots from central banks.

First, “there is nothing to see here, but we are monitoring the situation closely”. Second, “this bank is an outlier, and the system is fine”. Third, “we will add liquidity as a safeguarding measure, but we don’t see broad-based risks.”

We are slowly but surely seeing the first stages of the crisis playbook unfolding and the next steps are likely to follow in coming weeks even if central banks are not admitting to it yet. USD liquidity swap lines have now been changed to daily operations (from weekly), which is a first sign that central banks find this to be a liquidity crisis still, which is another signal that they always fight the last war. 2008/2009 proved to be an interbank liquidity crisis, while this crisis is different in nature. It is driven by the extraordinarily inverted yield curve and the lack of banks willingness to increase deposit rates.

Banks have a hard time dealing with an extraordinarily inverted yield curve due to 1) the risk of a deposit flight and 2) mark-to-market losses on bond portfolios. We can continue to explain these cases away as stand-alone cases, but the underlying reasons are found in monetary policy, and this is about as strong a hint that you get that the hiking cycle is over. The next part of the crisis is to consider cuts and then QE is ultimately also in play to safeguard the value of collateral in the system.

The Fed pricing is 50/50 ahead of Wednesday and we would not be surprised if the Fed delivered a hike that they will very soon thereafter regret big time.

Chart 1. Fed pricing ahead of Wednesday

The UBS deal with Credit Suisse was obviously better than a bankruptcy, but it is relatively evident that we are talking about a forced marriage. AT1 investors will be wiped out in the deal and even if this is only a $175bn market, it is likely going to lead to substantial spill-overs to the European banking sector. AT1s are obviously “below” equity from a hierarchical perspective, but at least some equity in UBS would probably have been expected by the investors. AT1s have sold off at record pace in Asia in this morning and the bleeding will continue during the day.

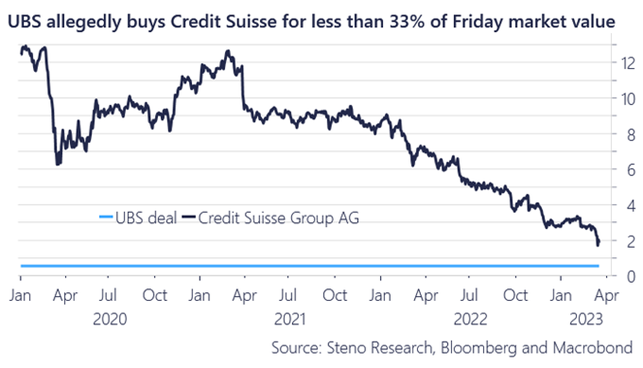

We also need to remember that the deal is at around 30% of the market value of Credit Suisse from Friday even with public intervention and liquidity packages included. There was no true bid for Credit Suisse and UBS has effectively been handed the keys for free. This is NOT a bullish signal for European banking stocks, rather the exact opposite.

Chart 2. A brokered deal WAY below Fridays close price

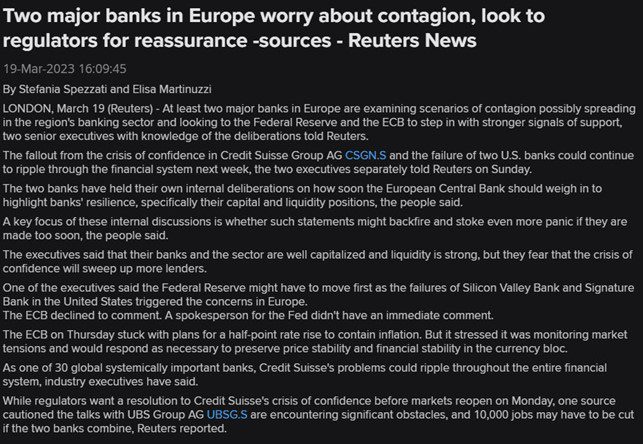

The ECB and European authorities are still stuck at phase one in the crisis playbook. “There is nothing to see here, but we are monitoring the situation”. Reuters reported yesterday that two major banks in Europe worry about contagion and have asked the ECB to step in.

The story was written by Stefania Spezzati and Elisa Martinuzzi. Look at the names and make your own conclusions on where those two “major banks” are from. I know what I think.

The crisis is going to accelerate until central banks put financial stability above inflation in their policy mix. It will take another while before that’s going to happen. Buy bonds with an arm and a leg in the meanwhile.

Follow our LIVE-blog at -> https://stenoresearch.com/banking-crisis-liveblog-week-2-credit-suisse

We will continue to update you on an hourly basis throughout the week.

Chart 3. Reuters article on two major banks in Europe

I do not understand this sentence from your excellent report: “AT1s are obviously ‘below’ equity from a hierarchical perspective, but at least some equity in UBS would probably have been expected by the investors.”

From Bloomberg: “In a normal writedown scenario, shareholders are the first to take a hit before AT1 bonds face losses, as Credit Suisse also guided in a presentation to investors earlier this week. However, under the terms of the government-brokered deal, Credit Suisse shareholders are set to receive 3 billion francs. That’s provoked a furious response from some of the AT1 bondholders as it hasn’t accounted for the seniority of CoCos over the lender’s shares in the capital structure. And that’s a big problem for a market that would expect holders to be paid before shareholders.”

Hmmmm…debt below equity in the hierarchical structure. Very strange, but since these are “COCOs”, convertible contingent obligations, seems like AT1s should’ve converted to equity and gotten paid along with the other equity holders. Watch for AT1 class action, since PIMCO owned a big slug of these.