Money Watch: Trillions of USDs are waiting to be unleashed

Money growth has improved lately in the US, while there are trillions parked on the time deposit / MMF side-lines. If the Fed cuts rates into the current rally, we may see another 2021/2022 melt-up.

***This is a snapshot of our institutional coverage from www.stenoresearch.com. Write to us at sales@stenoresearch.com if you are interested in an institutional coverage including BBG chats, calls and running ideas or chat us up on Bloomberg***

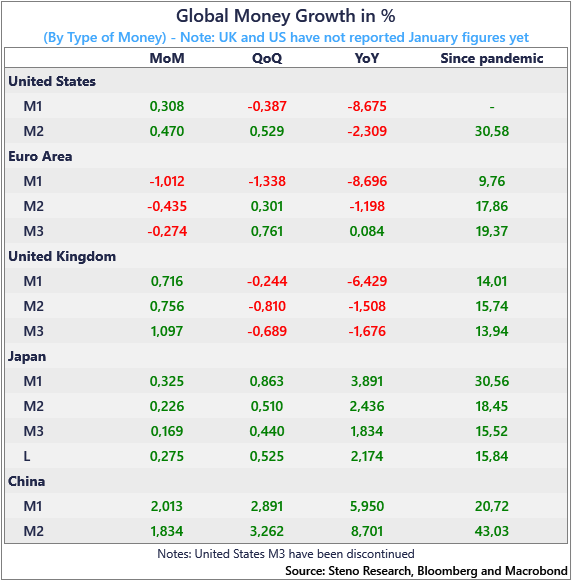

Money trends were abysmal for most parts of 2022 and the early parts of 2023, but we are starting to see interesting trends arising in the global money growth with clear geographical divergences.

Japan, China and the Euro zone have reported January M1, M2 and M3 developments and while trends remain benign in JPY and CNY, the money trends in EUR are re-worsening. A gap seems to be opening between USD and EUR money trends, which rhymes well with our strong thesis of a growing inflation gap between the US and the Euro zone.

What’s more, trillions of dollars parked a on the risk asset sidelines as the massive 30% growth of the broad money base is currently mostly parked in time deposits and money market funds.

Find out more below.

Chart 1: Money growth in %

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.