Last call for 20% off - 16 charts on US Macro ahead of the Fed meeting

Ahead of each FOMC meeting, we take the temperature of the US economy via a pamphlet of forward-looking indicators on inflation, growth and liquidity. Are conditions supporting a pause-narrative?

We intend on bringing a pamphlet of leading indicators ahead of major central bank meetings at Steno Research, which makes for a slightly more visual read than the typical boring pre- and reviews from investment banks.

Here is an extract from our “16 charts on forward looking conditions in the US” and an assessment of whether the conditions favor a bet on a pause from the Fed soon.

REMEMBER that this is the final chance to get 20% early bird discount as a subscriber to Steno Research.

The offer ends TODAY, so be sure to make good use of it.

Step by step: How to become a part of the Steno Research team?

1. Choose one of our offered subscription-packages

2. Use our coupon substack20 to get 20% off your first purchase!

3. Become part of the best macro team on the globe

4. Subscribe here → https://stenoresearch.com/subscribe/

If you want to buy a package of licenses and/or live access to the analyst team for your company or institution, please contact info@stenoresearch.com

US Inflation - compelling evidence of disinflation

Inflation has been in the limelight for the Fed reaction function in recent quarters, so let’s start with a bunch of forward-looking indicators of inflation.

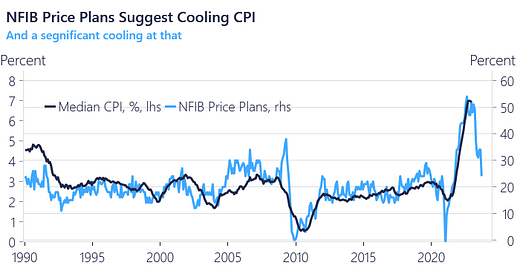

First, if we ask SMEs whether they plan on increasing prices or not, we get an almost 2019-like answer by now. A net of 20% of the surveyed companies in the NFIB questionnaire plan to hike prices over the coming period. This is usually corresponding to around 3% median inflation in 6 months from now.

Chart 1: SMEs are not hiking prices to the extent seen in 2022

US Employment - no signs of major stress yet, but wages have peaked

Most recent wage trends have started to support our disinflation hypothesis. The Atlante Fed wage tracker has rolled over, and the roll-over will continue if we ask the “live-gauge” from Indeed Hiring Lab on advertised wages. Wage growth has peaked (for now), which should spill-over to service inflation as well.

Chart 5: Wage growth has peaked

US Growth - Recession keeps getting postponed

Growth has continued to keep up despite recession chatter since Q2 of 2022. The cracks are finally starting to appear in various gauges and our weighted probability based monitor finds recession to be a marginal base case by Q3, but the model is yet to be overly convinced of the recession risk this year.

Chart 9: Recession risk indicator points to coin-toss for a recession by June/July 2023

US Housing - waiting for the confirmation of a 20% drawdown

The housing market is the final bastion that needs to truly fall before unemployment is likely to rise. Our forward-looking gauges have been relatively clear in recent quarters. We should expect a 15-20% nationwide drawdown during 2023

Chart 12: Where real rates go, housing follow

Short-term the double liquidity cushion from the ON RRP and the TGA will allow USD liquidity to remain benign relative to the central case from many market participants, but on the other side of a new debt ceiling deal, we should expect USD liquidity to drop towards $2.6trn as per the “Waller-rule”.

Short-term, this is a tailwind for equities, before a potential poor second half of the year again.

Chart 15: USD liquidity to remain benign for another few months

The offer ends TODAY, so be sure to make good use of it.

Step by step: How to become a part of the Steno Research team?

1. Choose one of our offered subscription-packages

2. Use our coupon substack20 to get 20% off your first purchase!

3. Become part of the best macro team on the globe

4. Subscribe here → https://stenoresearch.com/subscribe/

If you want to buy a package of licenses and/or live access to the analyst team for your company or institution, please contact info@stenoresearch.com

Misleading introductory offer, it only covers the VAT which is not included in the advertised price & it only applies to the first month.

Not sure I can justify subscribing when I already subscribe to Real Vision.