Inflation watch #1: 8 charts on slowing inflation and why it’s not a buy signal

US CPI printed at 7.1% - smack dab at our forecast - but it is not necessarily a signal to buy risk assets. Margins increased when inflation was hot. The opposite will happen now.

As one of the very few research houses globally, we actually had the CPI report spot on in our forecasts, and we remain very vocal that goods inflation is falling off a cliff, while the shelter component is going to be the only reason why inflation prints above target.

In this piece, we will show you our best forward-looking models on inflation and the links to equity space. And as per usual, we like more charts and less text. Enjoy!

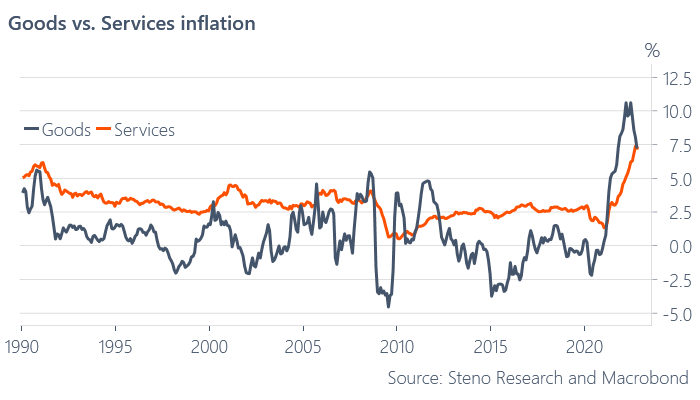

Goods disinflation vs. Service inflation, but how about actual deflation?

The monthly inflation report solidified what we knew already. Inflation is moving from goods to services and this trend is likely going to continue in coming months. We need to remember that CPI weights will be updated in January (earlier than the usual bi-annual schedule) as the weights are currently (too) tilted towards goods due to the pandemic consumption patterns

Chart 1. Goods and services sitting in a tree KISSING!

I know I have sounded slightly out of tune over the past months, when I have highlighted the risk of ACTUAL deflation in 2023, but I am getting increasingly convinced that it may turn out to be a decent call.

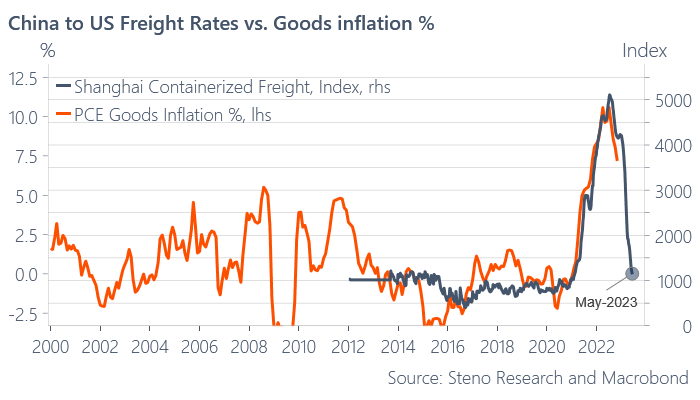

Freight rates point to 0% goods inflation in April/May 2023 on usual correlations, likely mostly as a result of a lack of demand for goods as the Chinese lockdown is still broadly as severe as earlier this year.

Chart 2. Goods inflation at 0% in 4-5 months from now… prepare accordingly

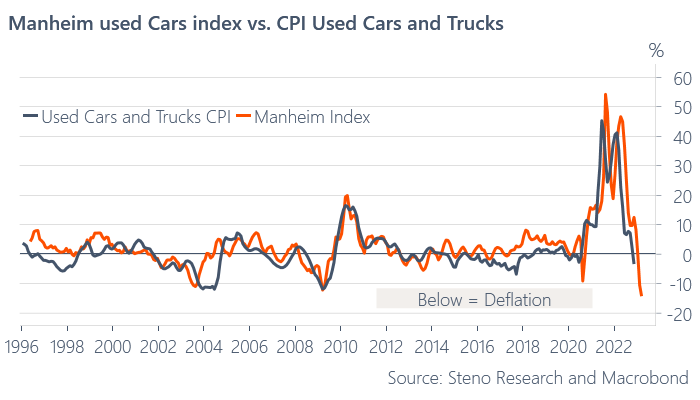

We already have outright deflation in various goods categories on a year over year basis and judging by auction data (Manheim index), we are ripe for the most severe deflation in car prices in the past several decades. When you shoot for the moon, you'll often land among the stars. The drop in goods prices is even more severe on a 3 month annualized basis, which now hints of outright deflation risks.

Chart 3. If you want to buy a car, then wait

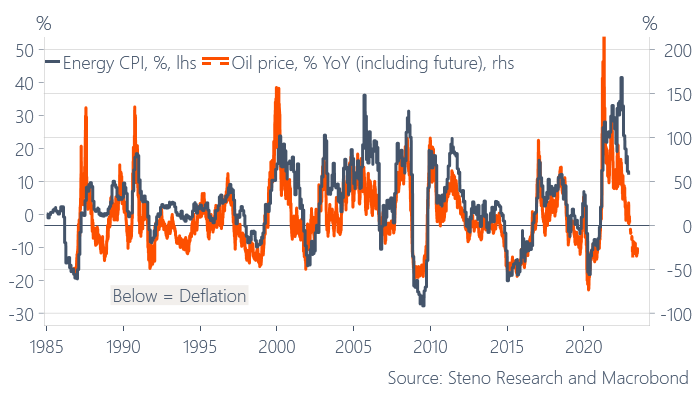

Energy is needless to say a CLEAR drag on inflation now and unless we get a remarkable bounce in oil prices over the coming 3-5 months, energy is bound to deflate in the CPI also in YoY terms by the early spring.

As the energy intensive sectors are currently faced with 1) high and rising inventories, 2) a weakening order book and 3) weak purchasing power developments among households, I remain bearish on energy (not least in stock space) for the time being.

Chart 4. Without a big rebound in oil prices, energy deflation is on the cards during the spring

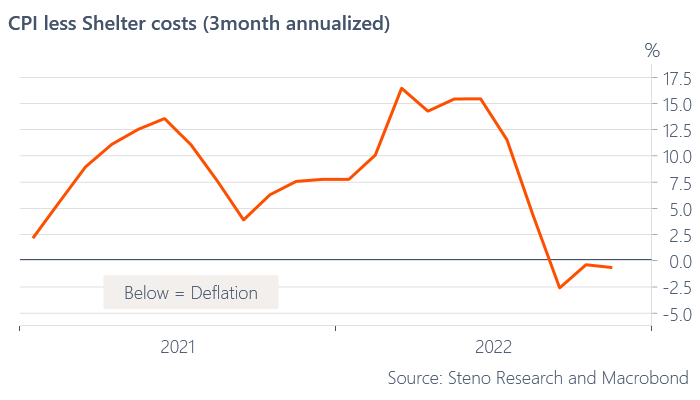

Is deflation a completely bizarre take? Well, this is the 3 month annualized inflation in the US ex shelter costs (the so-called homeless basket) and it is running in deflationary territory already. Remember this is the ENTIRE consumer basket ex housing, which by definition lags by 3-4 quarters at least.

Deflation cannot be ruled out for 2023.

Chart 5. Deflation in the entire consumer basket ex shelter..

If you buy the idea that inflation is falling rapidly now, let’s have a look at how to position in the equity space ahead of such a move..

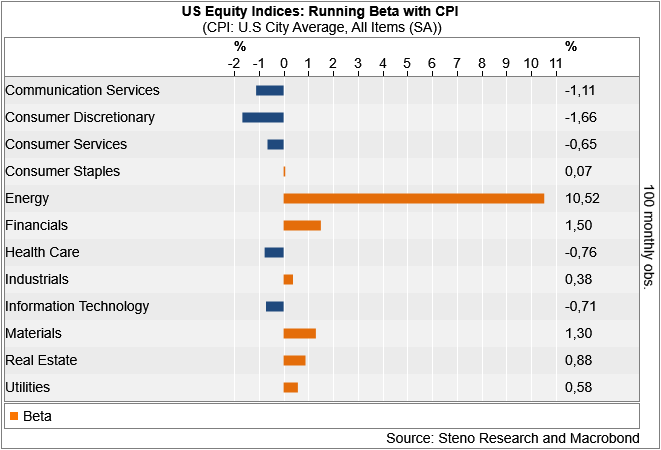

Energy is needless to say a HIGH beta equity sector to the CPI. Historically the energy stocks drop 10% for every 1-%-point drop in the CPI YoY. It probably won’t be that bad this time around. I prefer to play this story as a spread trade between Energy and Industrials, as industrials will gain from falling energy prices.

Chart 6. What to buy and what NOT to buy if the CPI continues to drop

The vanilla reaction to a slowing CPI print is to buy risk assets AND bonds at the same time.

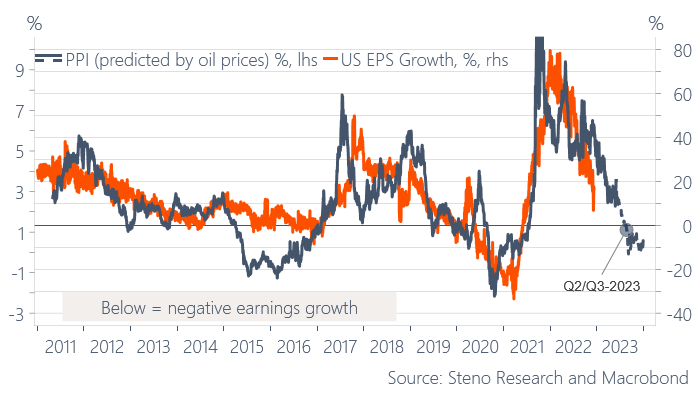

Those who find a lower inflation print a good opportunity to buy risk assets should look away now.. Remember that the PPI (and the CPI for that matter) is a leading indicator for EPS.. And if we allow the oil future to predict PPI, then we are in for negative EPS growth already during Q2/Q3-2023. Margins are widened on the way up, and compressed on the way down due to demand effects in either direction.

This is NOT priced into expectations for equities. A revisit of the 3500-3600 zone should be on the cards for S&P 500, while being long bonds in the belly of the curve looks like a very decent bet (2s5s may steepen a tad) despite the recent surge.

Chart 7. NO, slowing inflation is not a signal to buy equities

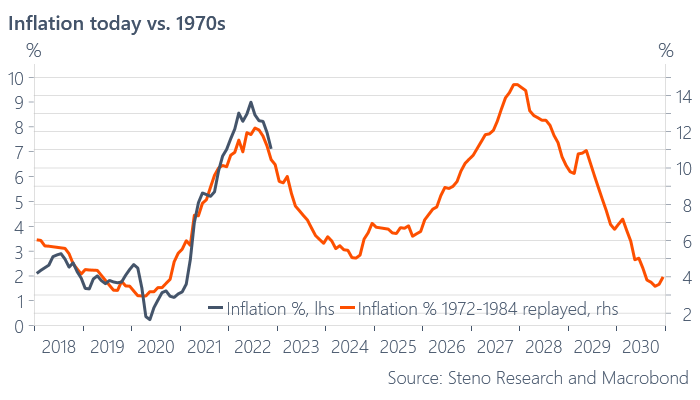

Having said all this, I am still of the view that the 1970s playbook is intact.. Once the disinflation in goods spills over to services through the spring of 2023, everyone and their mothers will yell at the Fed to pivot the policy stance (also those currently yelling about too high inflation)..

The Fed intends on plateauing interest rates at 4.5-5% for a prolonged period, which is simply not a feasible policy path. You either lean in one direction or the other as a central bank. It is politically impossible to communicate complete neutrality.

So, even if Jay-Poww is trying to “keep at it”.. I wouldn’t be surprised, if that platform “Burns” by the end of Q2-2023..

Chart 8. 1970s double-top inflation playbook is still intact

Nice one Steno. I like and appreciate your analysis. I also agree with it. If you have not already done so, I suggest you listen to; The Final Phase of the Bear Market by Felix Zulauf. It's on Youtube via interview by Blockworks best in class, Jack Farley. Felix's economic and market outlook, as well as his call on the timing aligns with both your view and timing. Cheers, Filo

Thanks for post, keep up the good work.

Questions: Author wrote: "...while being long bonds in the belly of the looks like a very decent bet (2s5s may steepen a tad) despite the recent surge." 1. In the belly of the....what? Omitted word? Typo? 2. Once typo corrected, please clarify what kinds of bonds you favor. For example, if you meant to say something like "in the belly of the CURVE" , then what type and duration of bonds are you favoring ? For what length holding period. 3. If you answer, how can I find the answer? Come back to this post in a day or so? Would I get an email notification of answer. Everyone deals with replies differently, it seems.