Flash Update: Trump Seeks an Off-Ramp as Peak Fear Hits

Trump’s strike on Iran risks escalating tensions, but with both sides seeking an off-ramp, markets may be vastly overpricing the threat of a broader conflict.

Written by Mikkel Rosenvold and Andreas Steno

Last night, President Trump carried out the anticipated strikes against Iranian nuclear facilities at Forlow.

You probably all know the backdrop, so let’s look ahead. Trump is under immense pressure from his Republican support base not to start a new war, which means he wants this over with quickly—as he has also stated. That opens up an opportunity for Iran. If they can hold out for 2–3 months (like the Serbians in 1999), they threaten to derail Trump’s domestic and global agendas: the big, beautiful bill, the trade talks, Ukraine, etc.

Trump needs an immediate off-ramp. That’s why the U.S. seemingly went out of its way to signal that this was intended as a one-off strike—perhaps even informing the Iranians of their intent.

Now, the Iranians have very little incentive to surrender, as Trump has previously demanded. Why would they, when they know he’s racing the clock? More likely, the U.S. will tolerate a measure of Iranian retaliation on Sunday or Monday, and then present a very limited form of “surrender”—more like a white peace, where both sides agree to cease hostilities without further concessions or changes to the status quo.

That could be acceptable to Iran if it offers them a face-saving off-ramp where they aren’t seen as capitulating to the West or Israel.

This is our best prognosis of the timeline from here.

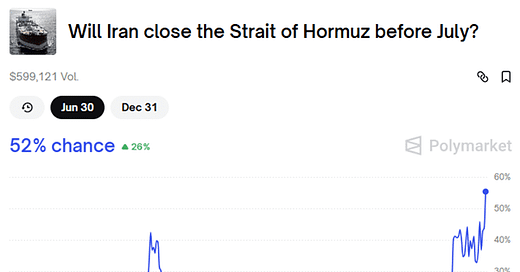

Chart 1: Prediction markets now see a closed strait as the base-case - nonsense

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.