FINAL CALL: Steno Signals #206 – Is the GENIUS Act in fact an act of genius?

The GENIUS Act, signed into law by Trump late last week, may have a lasting impact on everything from monetary to fiscal policy. There are signs of a tech revolution unfolding beneath the hood.

***Action Required to Continue Receiving Steno Research

Steno Research is joining forces with Real Vision! To continue receiving our research, you’ll need to sign up through Real Vision. This is the last call!

If you’ve prepaid for a full year on Substack, please contact us at info@stenoresearch.com, and we’ll guide you through the process. For everyone else, please visit https://app.realvision.com/pricing to sign up.

We look forward to seeing you over at Real Vision! ***

Greetings from Portugal, writing this as the sun sets on another lovely day along the Atlantic Coast.

The GENIUS Act and the subsequent ETH-hysteria have gotten me worked up to the extent that I dared to call it the “ChatGPT moment” for the stablecoin market. In this piece, I intend to examine the more medium-term consequences of this new piece of crypto-legislation through the lens of both monetary and fiscal policy.

No one’s done more work on monetary plumbing than I have (sorry—I’ll dial back the Trumpesque rhetoric now), and I believe this legislation will reshape how we think about everything from crypto to fiat funding markets. My overall take is that this is the single best piece of legislation to come out of the Trump administration so far—and a clear sign that the “tech revolution” is working its wonders beneath the drama and spectacle of the administration.

Before we discuss the ramifications for everything from T-bills to the USD market, let’s briefly revisit the main points of the new legislation—and the use case for stablecoins. And remember, this is seen through the lens of a macroeconomist, not a tech dude.

The GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins—marks the first serious stab at federal stablecoin legislation in the U.S., and surprisingly, it’s... actually good. Signed into law by Trump last week, it creates a clear framework for who can issue U.S. dollar–backed stablecoins, what kind of reserves they need to hold (think: cash and Treasuries, not crypto tokens or junk debt), and how they must disclose those reserves. Only certified entities—whether they’re banks, credit unions, fintechs, or possibly even big retailers—can be designated as "Permitted Payment Stablecoin Issuers" (PPSIs). Monthly audits, strict transparency, no funny business with collateral. It’s a big deal.

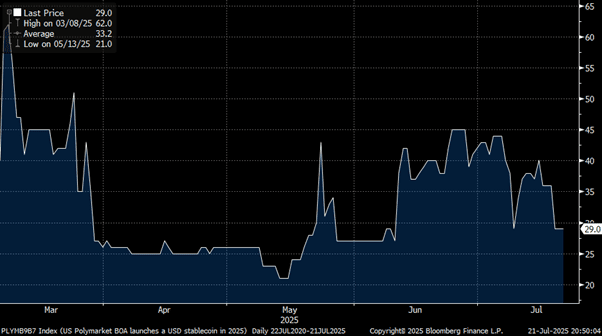

Chart 1: Will Bank of America issue a stablecoin?

So, when do you actually need a stablecoin? The answer is: probably more often than you think. Stablecoins are crypto’s version of digital cash—borderless, fast, and now legally legit. You might use one to park profits from a Bitcoin trade, move money internationally without fees and friction, get paid for freelance work in Argentina, or even run on-chain payroll or treasury ops for a DAO.

They’re essential for traders, useful for businesses, and increasingly hard to avoid for anyone operating in or around digital assets. And now, thanks to the GENIUS Act, they might just be the most regulated—and ironically most trusted—part of the entire crypto stack.

This is a big deal, as it will allow for institutional adoption on a scale that was previously incomprehensible. The Polymarket odds of Bank of America launching a stablecoin already in 2025 have also been on the rise, currently resting around 30% after briefly touching the 50/50 zone earlier in July. My bet is that every serious institution will be chasing this sooner than you think.

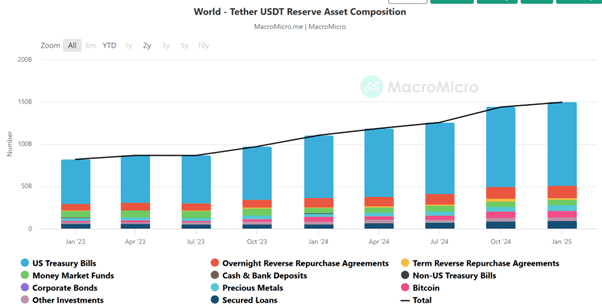

We obviously already have huge Stablecoins issuers in Tether (USDT) and the recently IPO’ed Circle Group (USDC) and these monster treasuries are already massive holders of Treasury securities. Take a look at the latest break-down data from Tether below. They have now surpassed the holdings of Treasury instruments in Germany, which goes to show the scale of this -and why this is a smart way for the US Treasury to find new buyers of the ballooning US debt.

Chart 2: The stablecoin market is already a big buyer of UST instruments

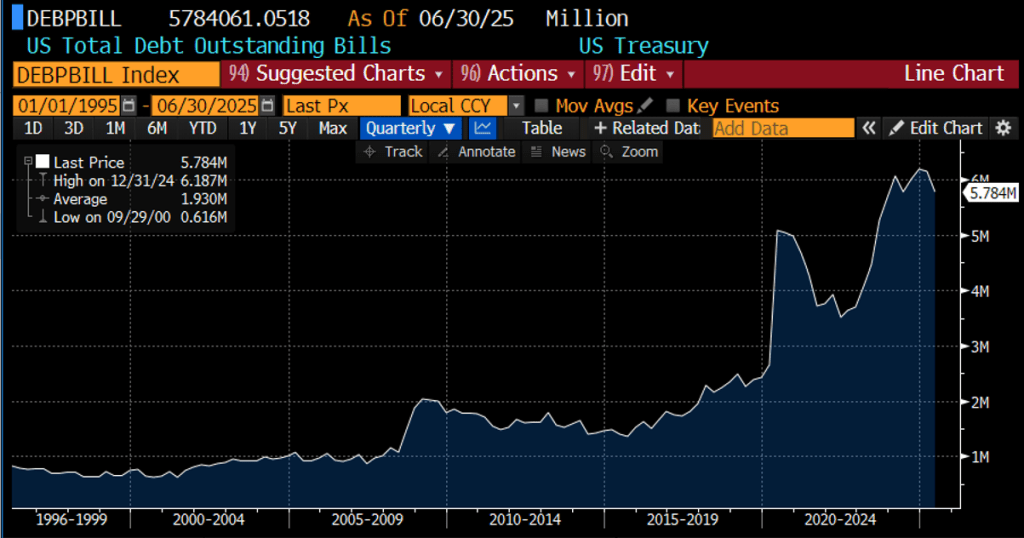

Tether probably holds over $120 billion worth of T-bills at this point, which amounts to a noteworthy >2% of the total outstanding stock of bills (currently $5.76 trillion). If we assume that banks en masse begin issuing coins with 1-to-1 backing by U.S. Treasury instruments, we’ve suddenly entered a whole new territory for the funding market—one with a deep pool of eager buyers, as long as Scott Bessent and his team continue favoring short-term funding profiles, which they’ve recently admitted to doing despite earlier criticisms of Yellen’s similar approach.

The self-imposed soft cap of 20% on the share of T-bills relative to total outstanding debt has already been breached several times in recent years (and we currently stand just above it). So why not fund more of the issuance on the short end, especially as the stablecoin market grows? After all, stablecoin issuers are restricted from backing coins with instruments further out the curve. This would also serve Trump’s interests in reducing debt-servicing costs. And as we saw clearly last week, when the Powell-layoff headlines re-emerged, the long end of the curve doesn’t like the current fiscal and monetary trajectory—a view that was also reinforced by the bond market revolt following last year’s ill-timed mega-cut just ahead of the election.

In that sense, the GENIUS Act may indeed prove to be an act of genius—securing a stable, scalable source of financing for short-term instruments, and giving Bessent more flexibility in his issuance strategy.

Chart 3: T-bills outstanding remain exceptionally high and more will come

What about the impact on the USD? There is still a mile—or actually, plenty of miles—between the GENIUS Act and the point where stablecoins could become part of the FX reserves of foreign central banks, especially since a hybrid CBDC-stablecoin model now seems to be off the table, with the bill clearly rejecting any central bank digital currency prospects.

The USD is back on a weak footing, and we consider the GENIUS Act another stepping stone toward the weaker dollar that the administration—albeit not officially—appears to favor in order to help close the (trade) deficits with the rest of the world.

If anything, the GENIUS Act will further solidify the global “bull steepener” that has emerged in recent quarters—a dynamic that is typically highly re-inflationary, as it allows private banks to ramp up credit creation (borrowing short, lending long). We usually see a weaker USD in such an environment, and EURUSD, for instance, has already bounced off trend support earlier this week—likely a signal that the dollar is set to weaken further, especially if a lame-duck Fed Chair is nominated soon.

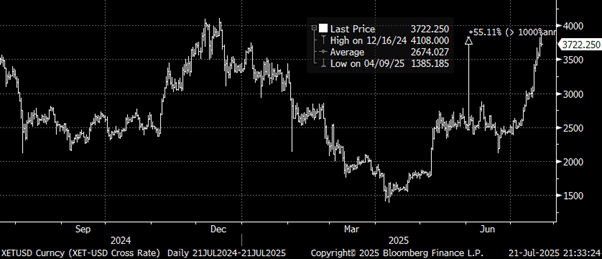

Chart 4: EURUSD has bounced on trend support

So what does it mean for markets? ETH has obviously been on a tear in the run-up to this legislation as the “mother of stablecoins,” and I agree with the take that this is a “ChatGPT moment” for ETH, as all major institutions will likely build on Ethereum when they launch stables.

We’re also starting to see retail participation coming in now, with Google Trends surging markedly this week. There’s probably a bit of “buy the rumour, sell the fact” baked into the current price action, but that doesn’t diminish the medium-term implications of this move.

This will further solidify ETH (and other chains) in the ecosystem and also make it increasingly clear why there’s a structural distinction between BTC and ETH. A capped supply like Bitcoin’s works well as a store of value, while an uncapped supply like Ethereum’s serves better as a store of transactions.

I’ve always said this—even since BTC’s early days. You're never going to see Bitcoin become a mainstream means of transaction when the nominal supply is capped, because that leads to material deflation during periods when the medium of exchange is hoarded. Goods would effectively become worth less and less in Bitcoin terms. In contrast, Ethereum’s layered architecture allows for monetary expansion when needed—which naturally limits its store-of-value potential, but enhances its transactional utility. That’s just how monetary mechanics work. And we’ll see this distinction play out in practice over the coming years. ETH will only rise in value if tech adoption outpaces its “printing,” while BTC is digital gold—it will never become a means of transaction, but who cares, as long as the network and store-of-value use case keep expanding?

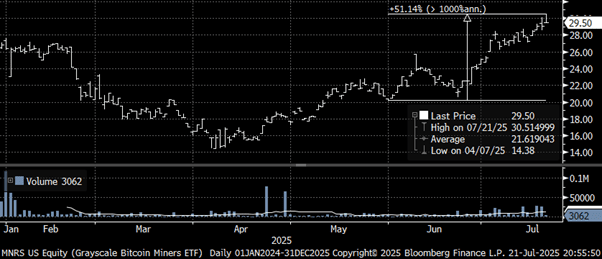

Finally, I’ve been asked why I’ve turned bullish on miners. The reason is that we’re in a superb sweet spot right now: input costs are very contained, with oil and energy prices low and stable, while the BTC reward is rising in fiat terms. That creates the conditions for an exponential increase in cash flow for the most efficient miners—a profile that can temporarily outperform Bitcoin itself.

Chart 5a: ETH is up 55% since June

Chart 5b: Miners are up 51% since June

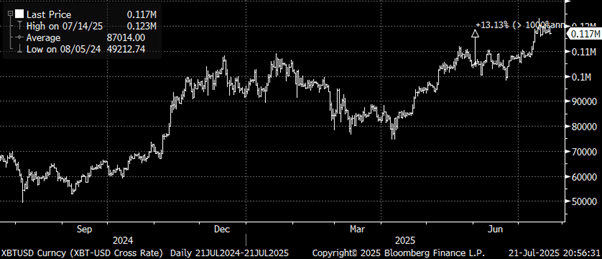

Chart 5c: Bitcoin is up 13% since June

Moving to RealVision, Raoul Pal’s “crypto” scam-coin center, is a mistake, IMO.

On another subject, why is it good that the GENIUS act limits who can issue stablecoins? Doesn’t it favor central-bank-supported banksters over entrepreneurs, just as many financial regulations have over the decades?

It feels like you're changing the system too frequently. I'm worried it might even change again next year.

Also, as someone who has subscribed to Steno Research since its launch, I'm disappointed with your response to things.

Answering inconsistently based on what suits you also seems a bit strange.

good luck