Energy Watch: Can oil rally 25% further in Q4?

There is a sudden smell of 2021/2022 in the air again as Muftis and Zars suddenly have the upper hand in energy markets again. Can Bin Salman make life difficult for the West in Q4?

As some you of you already know, we track energy intensively at www.stenoresearch.com and have been long Energy since the early summer.

Today’s developments with prolonged supply cuts from OPEC+ might distort markets substantially through Q4 and cause another big rally in energy prices.

Welcome to this short and sweet Energy Watch on the back of the Saudi/Russian decision to prolong cuts of supply through Q4.

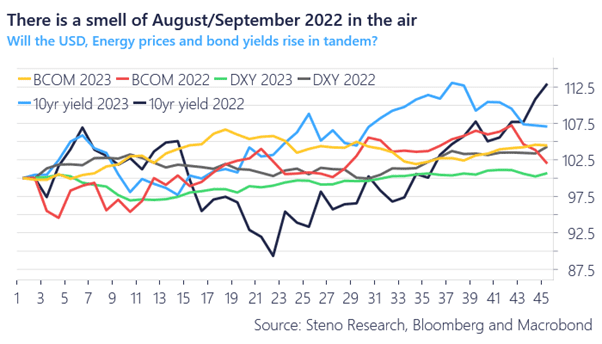

It leaves a smell of 2022 in the air and we note how the USD, bond yields AND energy/commodity prices move up in tandem. An odd cocktail, which can only happen, when Zars and Muftis are in charge of the supply/demand balance in global energy markets.

Here we go again!

Find 5 charts on why oil could move as much as 25% in Q4 with a subscription to our broader premium service here → https://stenoresearch.com/watch-series/energy-watch-can-oil-rally-25-further-in-q4/

Use Macro30 to get 30% off your subscription today!

Chart 1: 2022 all over again. USD, yields and energy UP!

The irony is here is that the high oil/energy price could end-up (esp. germany) hurting the economies so bad that the contraction in the real economy could deflate massively. Problem is that the rate next hiking decision is made with too much rear view mirror data bias.