[COPY] Steno Signals #194 – A Mar-a-Lago Accord- or Meltdown?

Part of the logic behind the Trump administration’s policy is to weaken the USD—but is the project spiraling out of control? Is there a viable path toward a less USD-dependent global system?

Happy Monday and welcome to my weekly editorial on everything macro.

Everyone’s talking about the USD meltdown and whether it marks a seismic shift in the international system as we know it. Markets are clearly responding to Trump’s list of “non-tariff barriers,” which notably placed FX manipulation at the very top. This aligns with the so-called Mar-a-Lago Accord principles recently outlined by Stephen Miran, Chair of the Council of Economic Advisers.

Miran proposed that the United States might pressure foreign nations—particularly those dependent on American military protection—into accepting a weaker U.S. dollar and lower returns (yields) on their holdings of U.S. Treasury bonds. In return, these countries would continue to benefit from U.S. security guarantees—effectively tying financial concessions to geopolitical alignment.

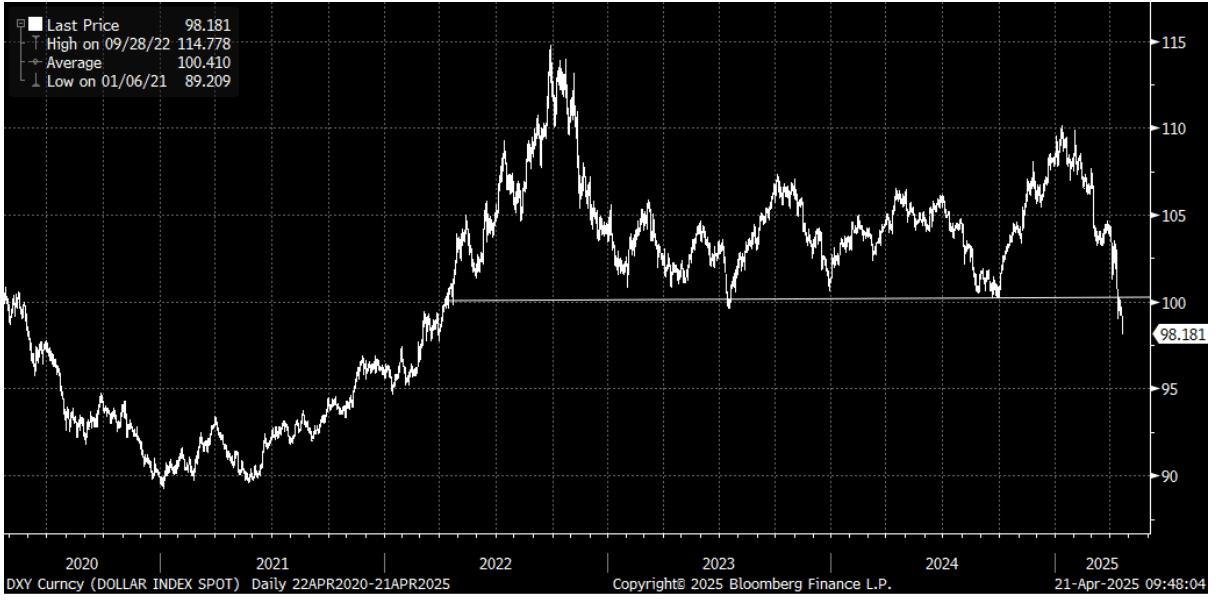

While this strategy envisions a controlled weakening of the USD index in exchange for geopolitical concessions, more USD liquidity, and increased foreign demand for Treasuries, it currently appears to be spiraling out of control for the U.S. administration.

We’re now witnessing a clear disconnect between the USD and U.S. bond yields, which was never part of the plan. If foreign buyers of Treasuries refuse to cooperate with these principles, we could face a scenario where the USD weakens and the Fed is forced to step in once again as the marginal buyer of USTs—effectively creating a USD double-whammy.

What was meant to be the Mar-a-Lago Accord might just become the Mar-a-Lago (USD) Meltdown. Here is our plan on how to deal with these risks.

Chart of the week: The USD is breaking DOWN

Keep reading with a 7-day free trial

Subscribe to Stenos Signals to keep reading this post and get 7 days of free access to the full post archives.