Bond Watch #1 - Why Bank of Japan's YCC tweak may be positive for US Treasuries

The Bank of Japan surprised everyone with a change of its YCC policy yesterday, but it is not necessarily bad news for US Treasuries as it may change the trend in USDJPY. Here is why..

While most of us are currently being reeducated in the concept of inflation while simultaneously having to deal with it, Japan has been dealing with another species for what seems like forever; no-flation.

After having adopted rapid industrial development policies during the 1970s and 1980s, Japan experienced very high growth rates. In fact, Japan had a 5% larger GDP per capita than the US in 1980. Unfortunately, assets had inflated and in the early 1990s, Japan entered a stagnant macroeconomic and investment environment with rising unemployment and rising debt. A phase they have been struggling to get over ever since.

Enough with the history. Fast forward to today, or yesterday rather; To combat the domestic stagnation (if not deflation), the Japanese government has continuously levered up on record-breaking debt and unfunded liabilities via yield curve control - exogenously stimulating the economy in the hopes of achieving some decent nominal growth and inflation and inflation is now FINALLY printing above target in Japan, but that wasn't why the BoJ altered the YCC policy yesterday.

Chart 1: The 10yr JGB yield in the old and new YCC regime

Bank of Japan throwing a spanner in the mix

On Tuesday, the BoJ announced that it would allow the 10y bond yields to diverge 50 bps above as well as below the target of 0%. This was a widening of the band within which yields were confined to fluctuate - a widening of 100% from the former +/- 0.25%.

BoJ governor Kuroda explicitly expressed that this “measure” was not a rate hike nor an exit strategy (QE was actually increased by 25%), but yields on usually sleepy Japanese government bonds soared higher anyway. Evidently, the market wasn’t going to buy Kuroda’s non-tightening tale of this tweak to how the central bank keeps the government's long-term borrowing costs in check.

Chart 2: Japanese 10-year Government Bond Yield

But.. this move wasn't about the inflation picture, but rather a consequence of a dysfunctional JGB market as 8yr and 9yr JGBs traded with implied yields above the 10yr yield cap of 0.25%. The liquidity had become non-existent in 10yr JGBs and Kuroda and Bank of Japan had to act to ensure market functioning. The issue is that Bank of Japan is now effectively biting its own tail and markets will clearly test its willingness to defend the new ceiling of 0.50%

If 8 or 9 year bond yields start trading above 10s during Q1, you know what to expect from BoJ now and margin calls are likely as a consequence.. but this is NOT a marked change of policy from Kuroda. So don’t expect Kurudo to move further unless the market forces his hand. What happens after April-2023 when Kuroda's term ends is an open question, but our main take is that global inflation pressures have faded sufficiently to allow BoJ to resume its dovish stance by then..

Chart 3: 8s and 9s traded above 10s in yield terms forcing BoJ to act

Why this is NOT going to alter the bigger picture in USD bond space..

The long USD/JPY trade has been THE policy divergence trade of 2022 and the market has been net short the JPY throughout the year. The trend has been so intensive that the Japanese Ministry of Finance has instructed the BoJ to intervene against it several times throughout the year, which has allowed the BoJ to “burn” USD reserves in the process of doing so.

If the USDJPY trade reverses as a consequence of BoJs YCC actions, it may prove to be a biggie for USD fixed income, but in a counterintuitive way.

Chart 4. Positioning in USDJPY versus the actual moves in USDJPY spot

When the USD strengthens materially as a consequence of a tighter Fed and tight USD liquidity, foreign FX reserves of USDs tend to lessen due to outright selling of USDs by foreign central banks. This has been the case in Japan this year as well.

If the YCC move from BoJ pulls the rug from under the USDJPY long, which was already running on fumes due to an exhausted Fed tightening cycle, it is likely going to make life easier for BoJ in FX-terms. A weakening USD allows BoJ to build USD reserves, while the opposite has been the case so far this year. If the BoJ can start rebuilding USD reserves, it also means that they can start adding USD bonds again.

This may prove to be a self-fulfilling prophecy with positive spill-overs to US Treasury bonds. A lower USDJPY reading -> more USD FX reserves in Japan -> More Treasury buying -> Lower USD rates -> A lower USDJPY … you get the loop by now..

Chart 5: Stronger USD -> Less Japanese holdings of USTs and vice versa

The ultimate bellwether for whether Japanese lifers and pension funds buy USTs or not is the shape of the USD curve relative to the shape of the JPY curve. If the USD curve is steep (high 10s versus 1s), the JPY FX-hedged purchase of USTs looks attractive relative to JGBs (effectively receiving far-end USD-JPY rates versus paying front-end USD-JPY rates), while the opposite is true when the USD curve is heavily inverted as currently.

The current 3m annualized FX hedging cost of buying a 10yr UST seen from Japanese soil is closing in on 5%, which makes it very unattractive to buy USTs in Japan. A change of 25 basis points in the JGB curve is not going to alter that picture dramatically since the equation is already negative (3.70% 10yr yields - 4.90% annualized 3 month hedging costs).

A Fed pause or pivot is ultimately what will bring the Japanese lifers and pension funds back to the US Treasury table and a reversal of the USDJPY trade is a decent bellwether of that. The move in USDJPY is what you should care about instead of the tweaks to the 10yr yield in JGBs and ultimately this may turn out to be good news for USD duration.

We remain upbeat on USD bonds despite the BoJ action as a consequence.

Chart 6. The curvature of the USD curve is what matters to Japanese investors

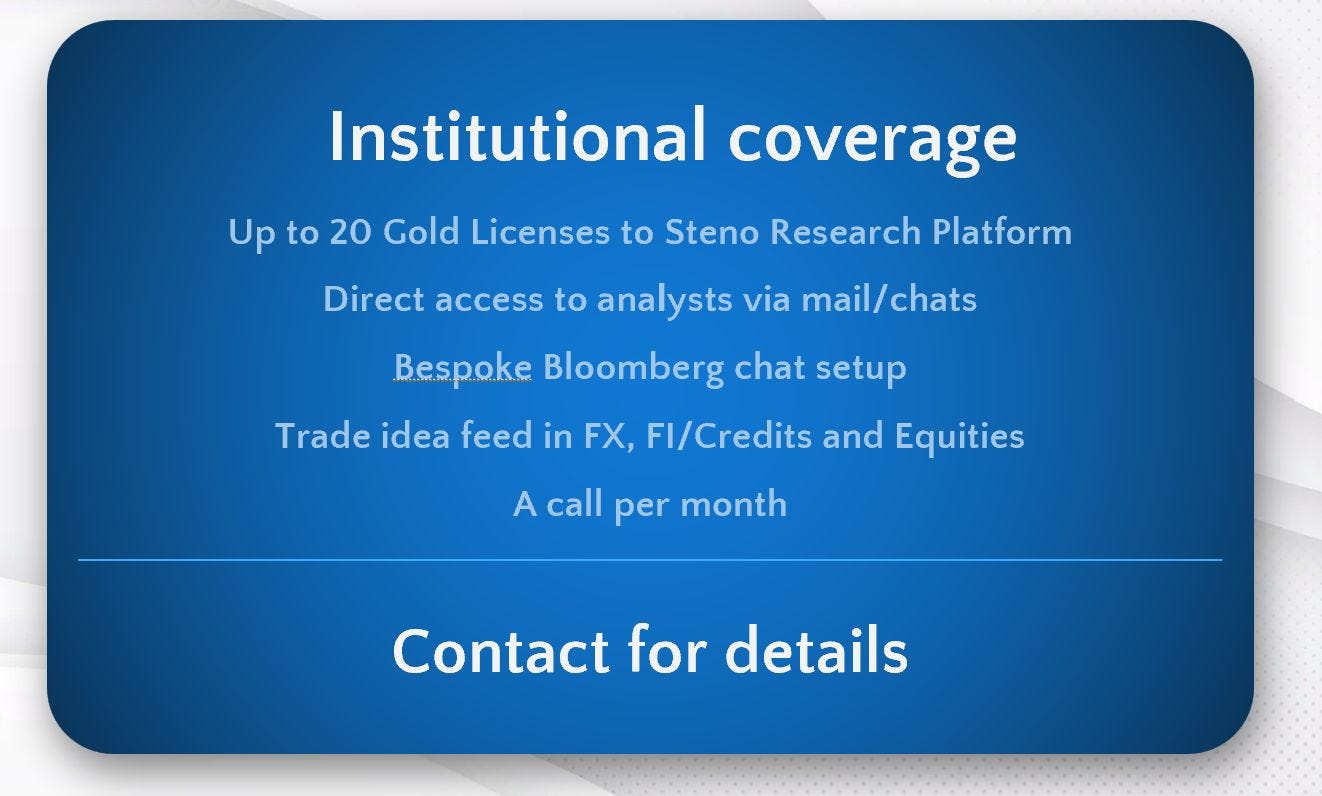

From January 2023 and onwards most of our research will move to https://stenoresearch.com/ … If you are interested in an institutional macro strategy coverage (FX, rates, energy and equities) please contact us directly for an early bird discount at andreassteno@stenoresearch.dk

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Thanks a ton and I learned a lot from your piece.

Just one suggestion, if you draw a graph between US2y - JP2y vs. Japanese holdings of US Treasuries, the fit/correlation of the two lines is even better.

Philosophically it seems like there is a bit of difference between growth driven inflation and inflation driven by external factors whilst having no growth (aka stagflation). Doesn’t seem obvious that BoJ will be celebrating to see 2% inflation when there is no growth?

No idea how that changes the investment environment but the response must be different?